Advanced Analytics

Leverage Dodge Data & Analytics in-depth tools to gain a deeper understanding of your market, identify growth areas and forecast demand

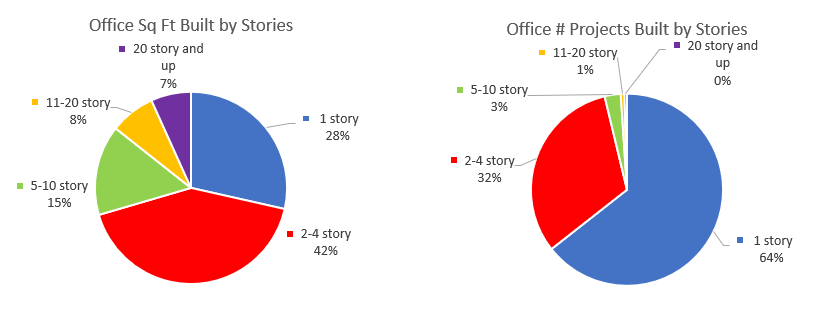

Gain an even more in-depth understanding of the details behind overall construction figures.

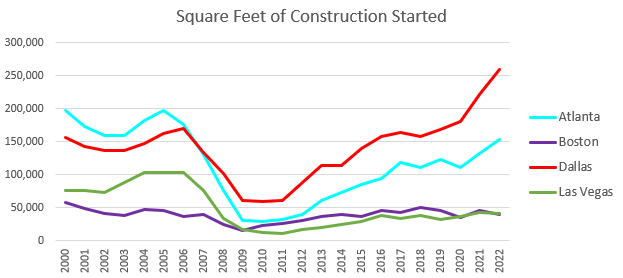

Dodge maintains a monthly statistical database of construction starts going back to 1967. This data provides the foundation for very detailed segmentation studies, as well as tracking and monitoring of markets on an ongoing basis. The information can be customized even further than in the Dodge MarketShare platform to target even more precise building types, project size ranges, and other building attributes.

Analyze long-term trends and patterns of recession and recovery cycles by markets and segments.

Find out where in the US has the greatest amount of inventory, in terms of square feet, of the types of buildings that matter to you.

Use this unique Dodge data to evaluate your opportunity for potential demand from existing space for fifteen different types of nonresidential and residential buildings.

Learn how your sales relate to construction activity.

- What industry metrics are the ones to follow?

- How does the difference in intensity of use change by building type? Do certain product attributes dominate in certain types — or in certain areas of the country.

- Where would be best for a new product launch? Or a new facility to be located?

Work with our analysts and economists to develop custom information that is key for your company.

- How is the market expected to perform in the coming years?

- Which building types have the best growth outlook?

- What areas of the country are strongest in the categories your business is focused on?

Dodge Construction Network forecasts activity by US, state, and metro areas – and by your specific sales areas – so that you can develop the best plan for your business based on the most respected construction forecasting in the industry. Customize the additional forecast attributes that matter to your business.

Learn what the demand for your residential product opportunity is by market and by product types.

Gain an understanding of how the selection of your products in new housing versus existing homes differs.

Understand what, or who, influences homeowners when they decide on your product or brand versus competition.