2024 Market Trends, Challenges & Outlook

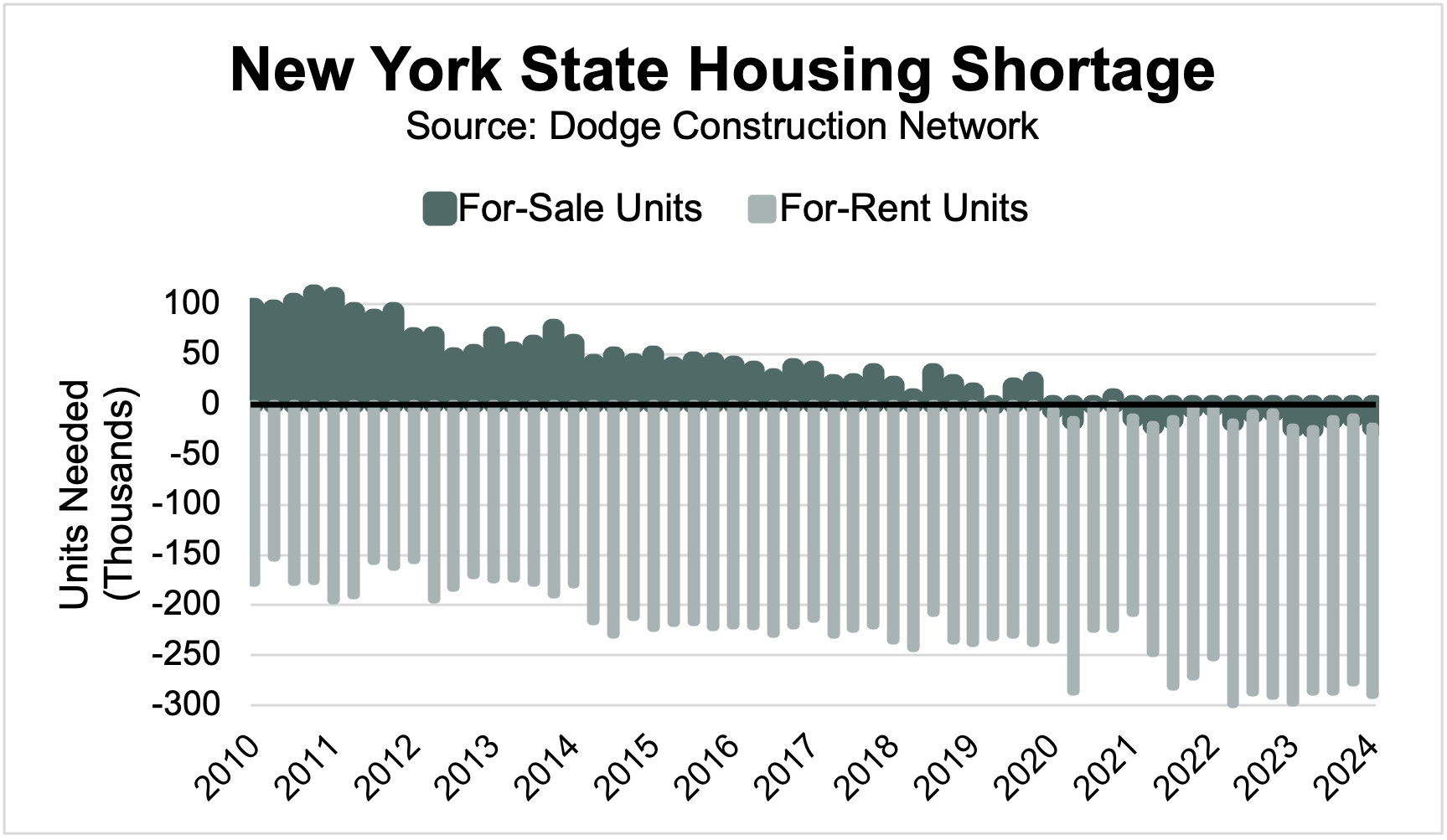

New York City’s housing market has faced its share of hurdles in recent years, leaving many to question where the largest apartment market in the country is headed. Indeed, New York state is currently facing a massive housing shortage. According to Dodge Construction Network estimates, the state’s housing deficit has hovered around 300,000 units since 2022, unable to return to its historically typical deficit of 191,000 units (between 1970 and 2019). To return to its long-run vacancy rate average, the state would need to add over 266,000 for-rent units and 23,000 for-sale units to the current stock. This analysis delves into the current state of New York’s housing market, examining recent trends and potential future developments that will shape the city’s residential landscape in 2024 and beyond.

Pandemic-related outmigration intensified today’s housing conditions

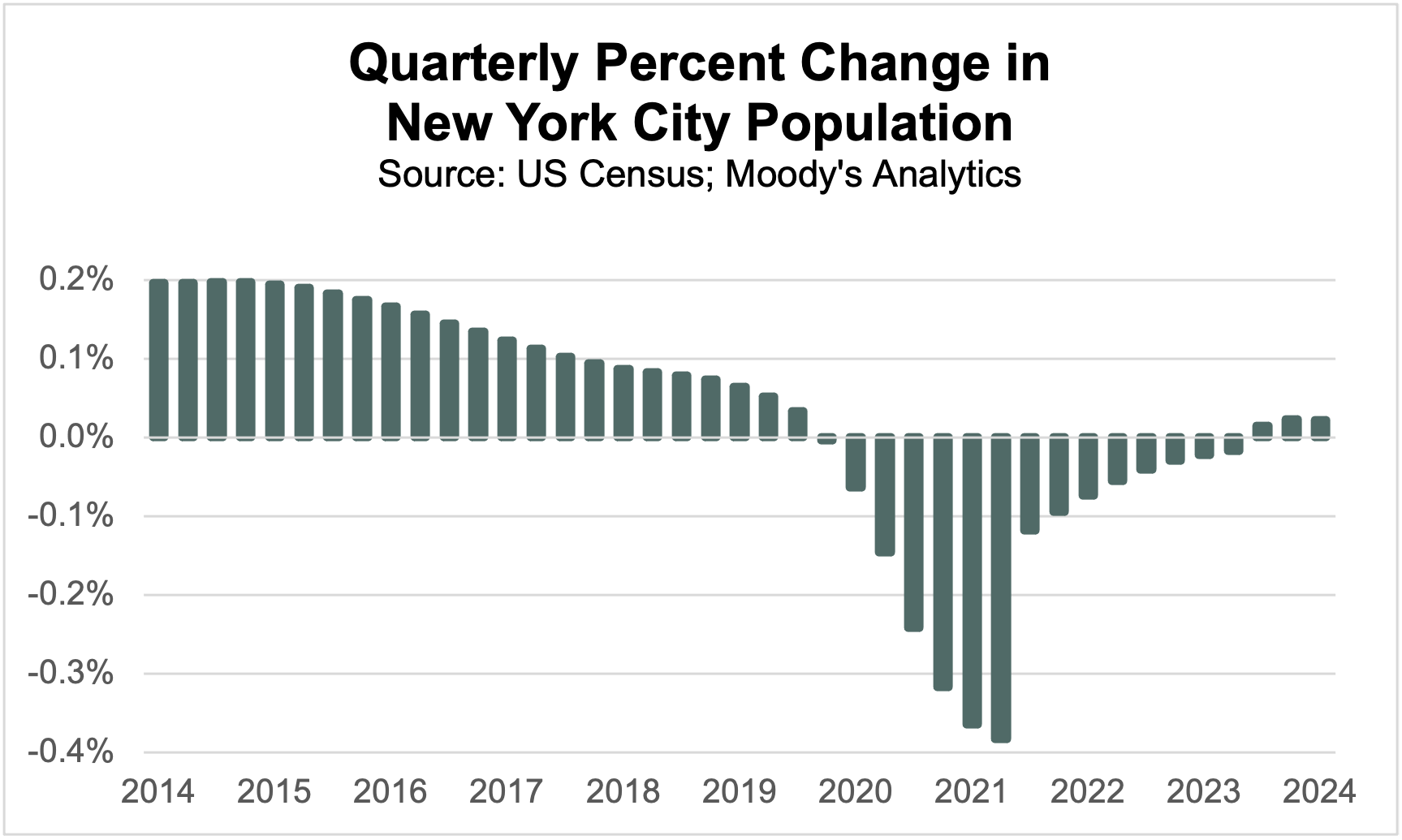

The COVID-19 pandemic created unique conditions in New York’s housing market that catalyzed demand for homes, while simultaneously limiting the market’s ability to increase supply. In the decade prior to 2020, total population growth in New York City grew by 7.7%, outpacing the rest of the United States. (U.S. Census Bureau; NYS Office of the Comptroller 2023) Almost all of this progress was credited to growth in natural population increase (births minus deaths), with only 1% related to net migration (both domestic and international). Much of that increase was reversed, however, when the City’s population fell 5.3% during the COVID-19 pandemic – driven almost completely by residents leaving New York City amidst widespread lockdowns.

Although New York City had already been facing a rising outflow of residents who struggled with high living and childcare costs prior to 2020, that exodus snowballed throughout the pandemic. According to the IRS, 35% more people left New York City in 2020 and 2021, compared to those that left between 2018 and 2019.

But the population of people leaving wasn’t all-encompassing. Those with higher-paying jobs, in sectors like business services or finance, had more flexibility to work remotely and reside outside the city. While more average-paying jobs, like those in the leisure and hospitality sectors, required in-person attendance and thus prevented the departure of those workers. This divergence lowered the share of households in NYC with incomes over $100,000 for the first time in a decade.

In 2022, when the dangers of the pandemic fizzled away, a substantial portion of those higher-income households returned to New York City, alongside more demand for hybrid work. But as the country faced a rapid increase in inflation, housing and rent prices soared and forced many lower-income households out.

Of the individuals who couldn’t afford to move away, many are now unhoused. New York City is facing the largest population of unhoused individuals in decades, recording almost 146,000 people sleeping in shelters in March 2024. (NYC Department of Homeless Services; Local Law 79 Reports 2024) While New York isn’t the only city facing increased rates of homelessness, it experienced the largest national increase between 2022 and 2023, growing 39.1% – followed by California (+6%) and Florida (+19%). (U.S. Department of Housing and Urban Development 2023)

The net rental vacancy rate for all housing in New York City reached a historical high of 4.54% in 2021, but quickly fell to a near-historical low of 1.41% by the end of 2023. (U.S. Census Bureau; City of New York 2023)

New supply continues to shift towards larger buildings and more expensive units

Even amidst the housing shortage, the total number of housing units in 2023 represented the largest housing stock in New York City in recent history, sitting at 3.705 million units – including 2.391 million renter occupied units. (U.S. Census Bureau; City of New York 2023) Most of these units are in buildings that were built before 1947 (54%), with only 5% of current stock in buildings built after 2010.

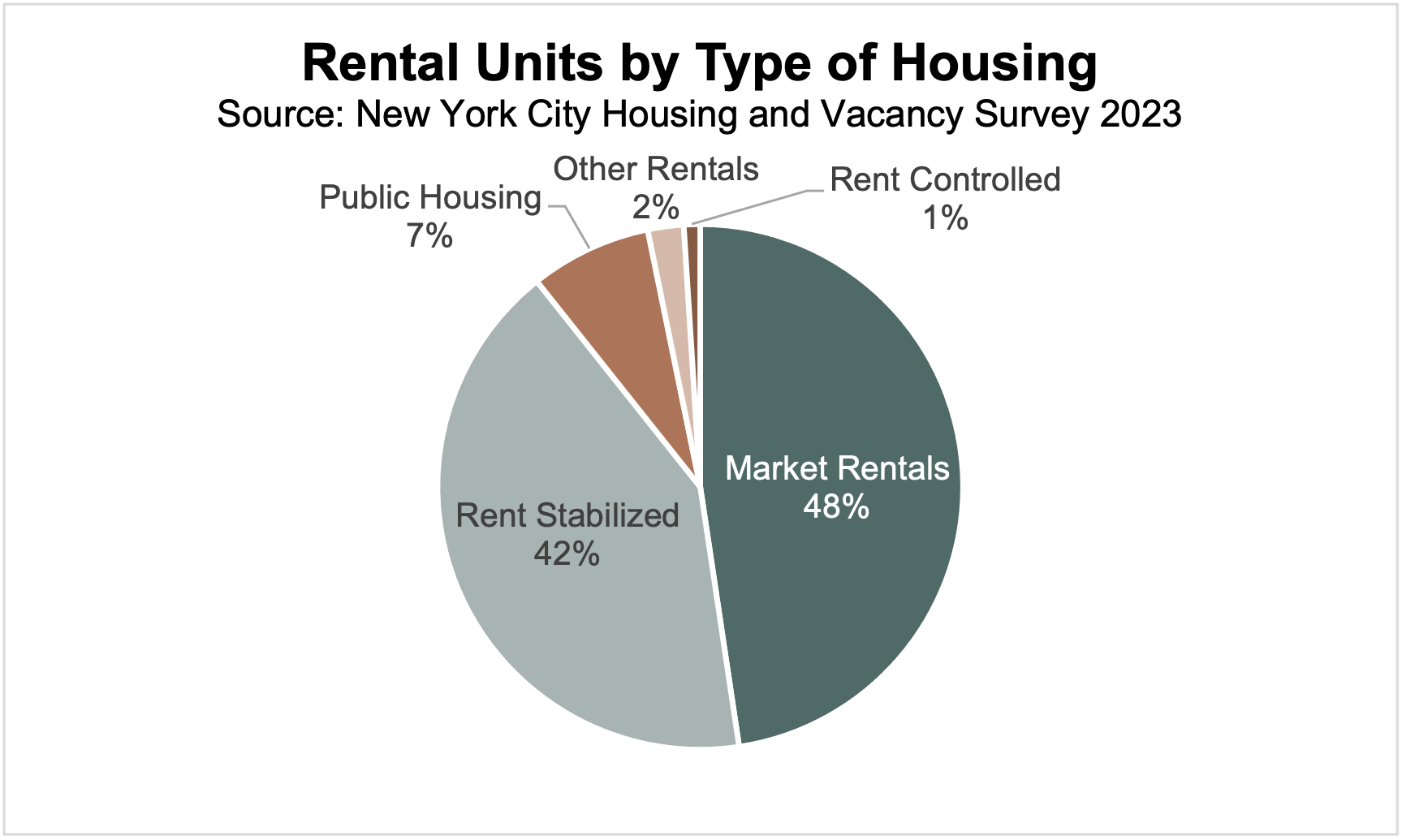

When looking only at renter occupied units, market rentals are the largest segment – accounting for roughly 1.14 million units last year (48% of total rentable stock). This is also the most expensive segment of the market, with a $2,000/month median asking rent in 2023. Rent-stabilized units make up another 42% of this stock and are usually located in buildings built before 1974. The median rent for this group was $1,500/month in 2023. Public housing, rent-controlled, and other rentals make up the remaining 10% of renter-occupied units. (U.S. Census Bureau; City of New York 2023)

Since 2020, the supply of affordable homes has diminished, as even the lowest-tiered apartments and homes were sold at unusually high prices and, often, torn down and replaced with more expensive housing. (Wall Street Journal 2024) Over 600,000 units with rents under $1,500 (inflation adjusted 2023 dollars) have left the housing stock over the last two decades, while 75,000 units with rents over $5,000/month have been added. (U.S. Census Bureau; City of New York 2023)

Last year, 52.1% of renters in the City were considered rent burdened, spending over 30% of their income on rent. (NYC Comptroller 2024) For publicly listed apartments, the median asking rent in 2023 reached $3,500 per month – requiring an income of over $140,000 per year to be affordable. This is much higher than the $76,607 median household income in NYC in 2022. (Census 2023) On the single family side, the median home list price in April 2024 was $769,000 – requiring a household income of $218,000 to be in-budget. (Heidenry 2024)

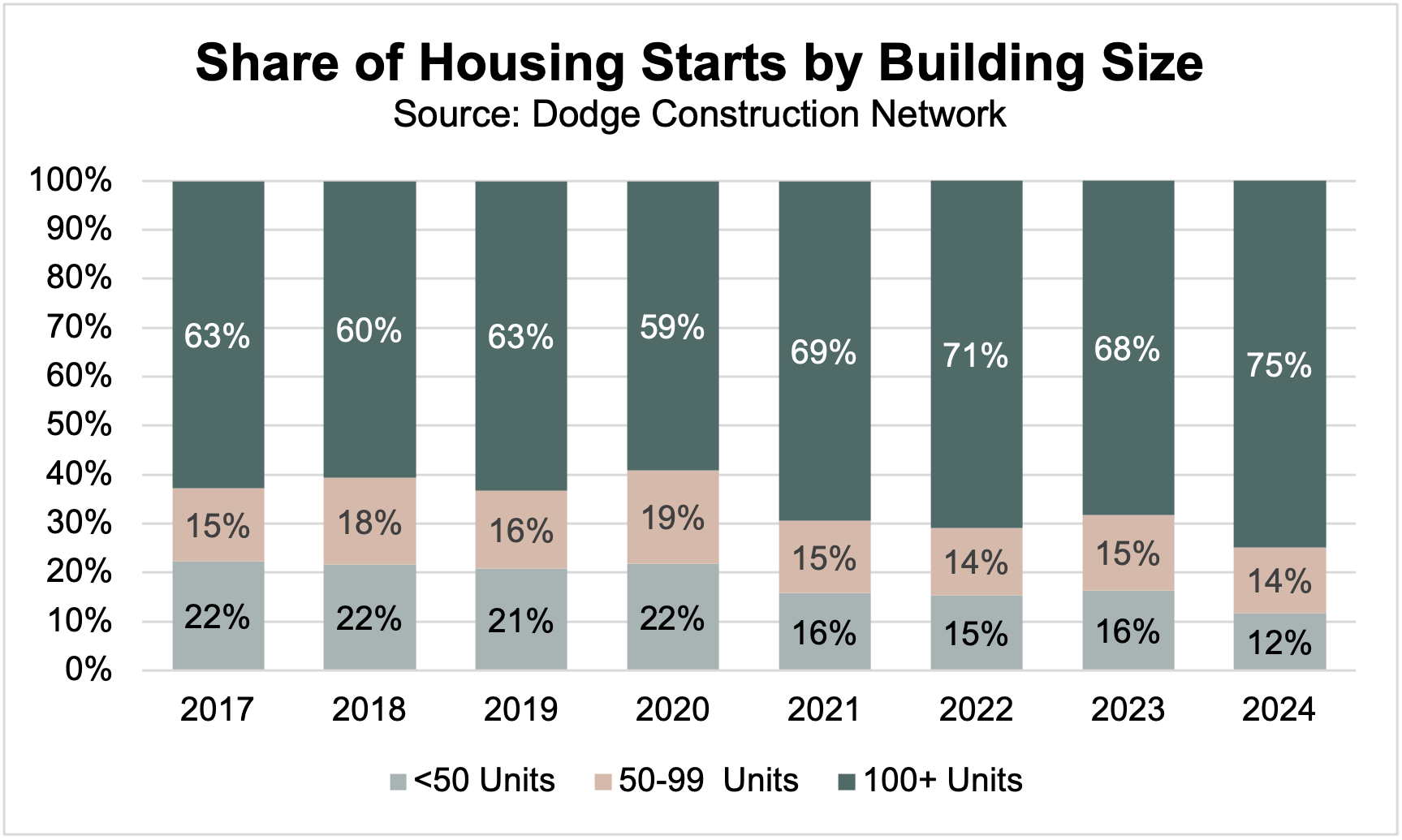

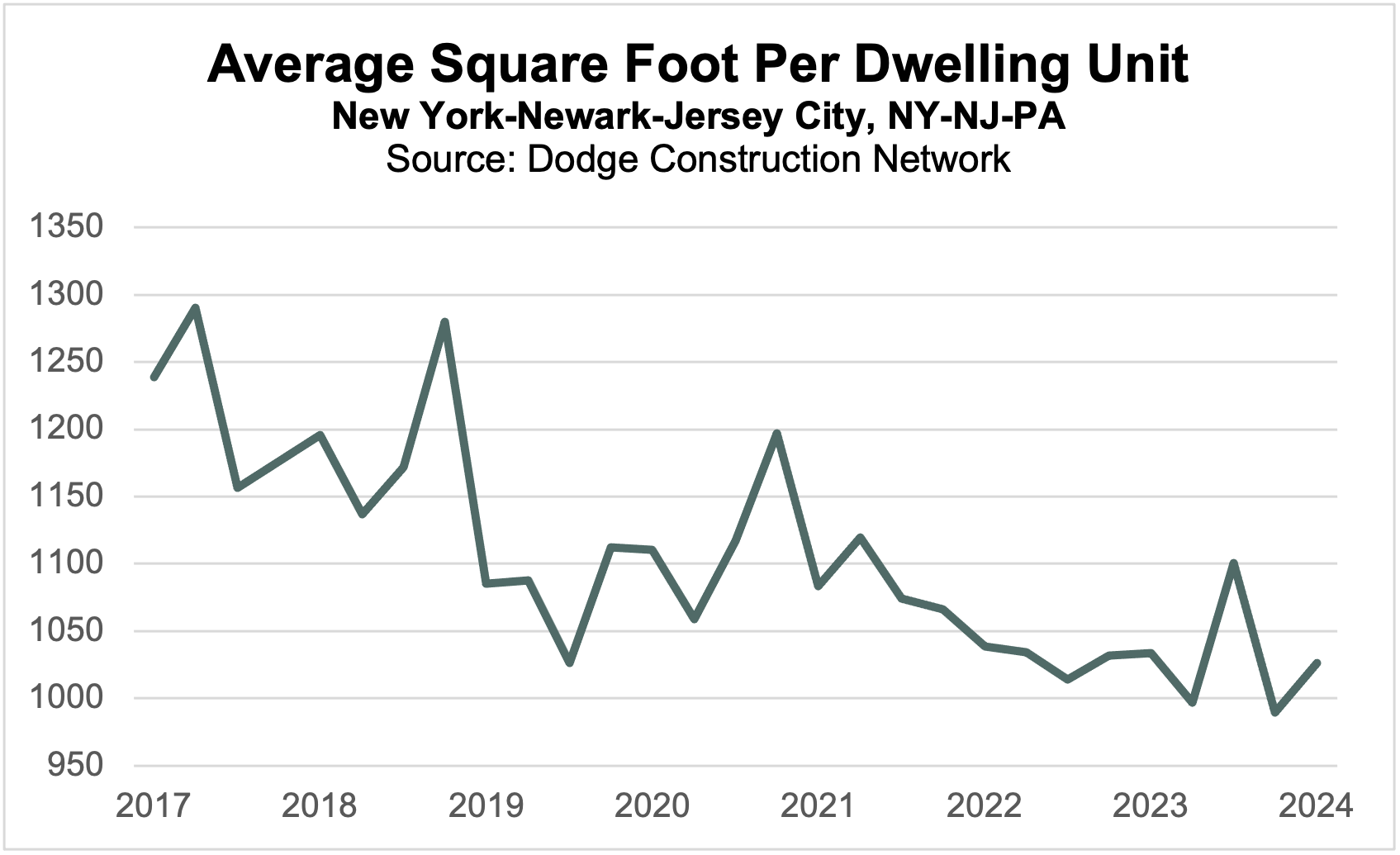

The rapid growth in prices has exacerbated the divide between higher and lower income households. Almost 70% of home sales in Manhattan were cash purchases in 2023Q4, up from 55% in 2022. (Chaffin 2024) Generally speaking, demand for more expensive units is driving more investment towards projects with over 100 units. According to Dodge Construction Network’s project database, 75% of total units that broke ground so far in the first four months of 2024 came from buildings with over 100 units, which is up 12% from 2017 levels. Moreover, the average square foot per dwelling unit (across all building sizes) has fallen 17% in comparison to 2017 levels – highlighting the prevalence of these higher-unit buildings that often have smaller units.

Renter and investor priorities are increasingly at odds with one another

An influx of 301,500 residents entered New York City between 2021 and 2022, most of whom were Gen Z (42.4%), single (67.2%), and renters (78%). (Sheidlower 2024) While Millennial rental demand, across the country, has peaked and is now in decline – Gen Z is quickly becoming the focal demographic segment for rental demand. Estimates say that Gen Z will fork out, on average, $226,230 in rent between ages 22 and 30 in New York City or $299,110 over the same 8 years if they bought a house (excluding a down payment) (Both 2024). Unfortunately, the reduced affordability of publicly listed apartments is going to have an outsized impact on newcomers to the city – compared to longer-term residents, who can remain in rent-stabilized units. Recent data already suggests that Gen Z individuals sought out more affordable cities in 2023, like Syracuse, New York.

To help relieve some of this price growth, the recently passed New York FY2025 Budget caps increases on free market rentals at 5% over the annual growth rate of the Consumer Price Index, with an overall ceiling of 10% annual growth. (Shkury 2024) While this will benefit renters, some experts are concerned that investors could be deterred by the new policy.

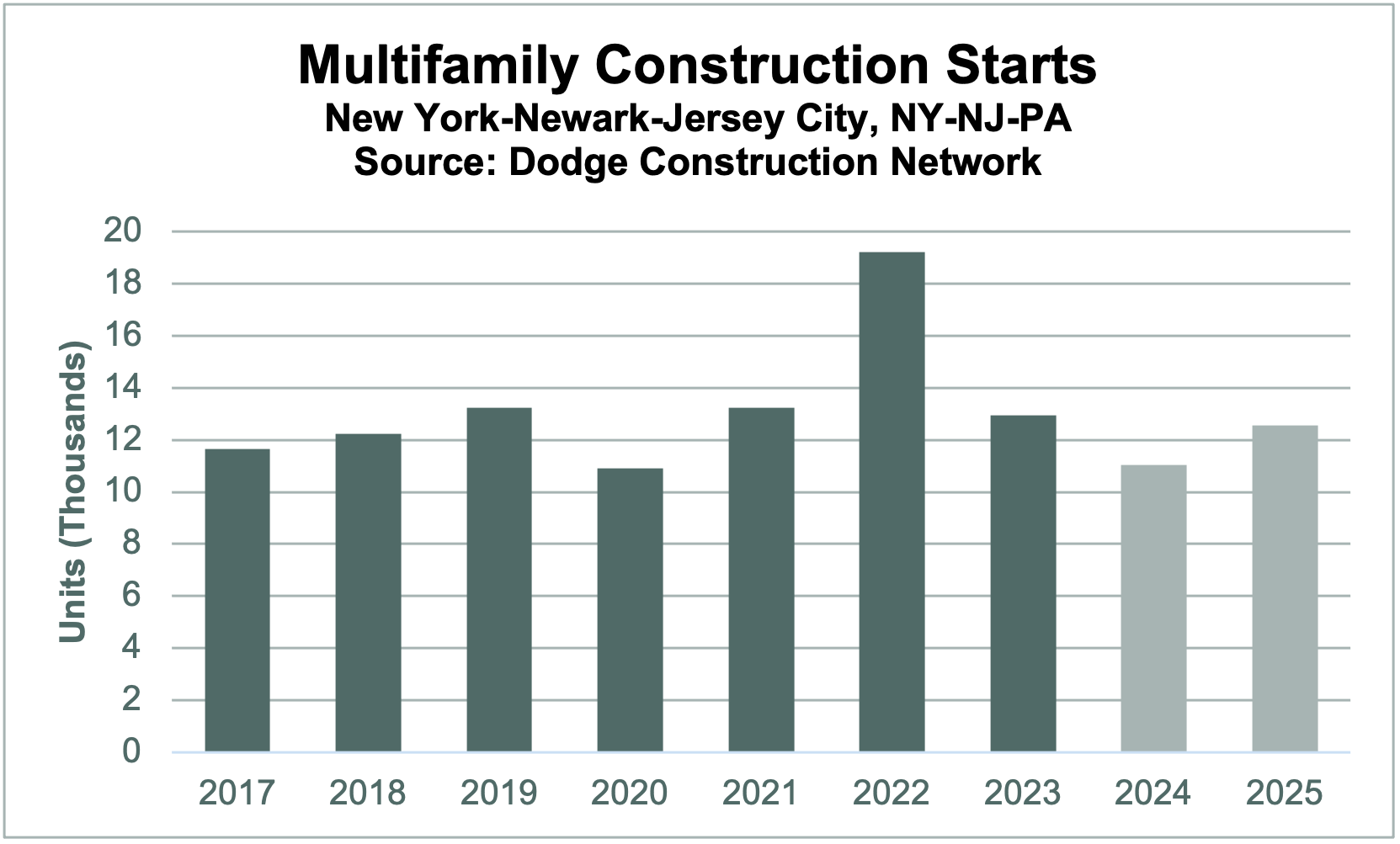

Much of the remaining renters in New York City live in rent-regulated apartments – which are subject to much stricter regulations on rent increases. While this has been critical for affordability, investors have shied away from these properties recently. As lenders tightened their standards throughout 2023, the value of these properties regressed 18% from peak levels. (Ariel Property Advisors 2024) The closure of Signature Bank last year, one of the largest lenders for rent-stabilized assets, limited financing options for owners and developers. Even as New York Community Bank (now the largest lender in the space) bought a large portion of Signature Bank’s assets, it reported $2.4 billion in losses on CRE loans in its fourth-quarter earnings report. (Rogers 2024) This has made it more difficult for investors to find financing and stay in the market. According to Dodge data, multifamily construction starts in the New York metro area expanded 45% in 2022 but fell back 33% in 2023 alongside those rising interest rates and tightening lending standards.

The expiration of the 421a tax incentive in June 2022 also contributed to the pull back in construction last year. Many owners and developers halted construction on 421a-vested projects, in hopes of a new tax incentive being passed down the road. Encouragingly, the new FY2025 budget includes two key features: 1) An extension until 2031 for those vested projects, and 2) a replacement incentive, called 485x, that lays out the new guidelines for the minimum number of affordable units within new developments.

Hotel and office conversions are becoming more common

Renovations to rent-stabilized units have also been hindered in recent years. The Housing Stability Tenant Protection Act (HSTPA), passed in 2019, capped eligible improvement costs at $15,000 per year – much lower than the average project cost of $100,000 to $150,000. As a result, many owners chose to leave units vacant instead of investing capital that couldn’t be passed down to renters. The recent FY2025 housing policy doubles that cap to $30,000 (reaching $50,000 for units that have been occupied the last 25 years or vacant over any of the last three). Owners of rentals in the outer boroughs are more likely to benefit from the increase, while those in pricier areas may still be unable to make the math work.

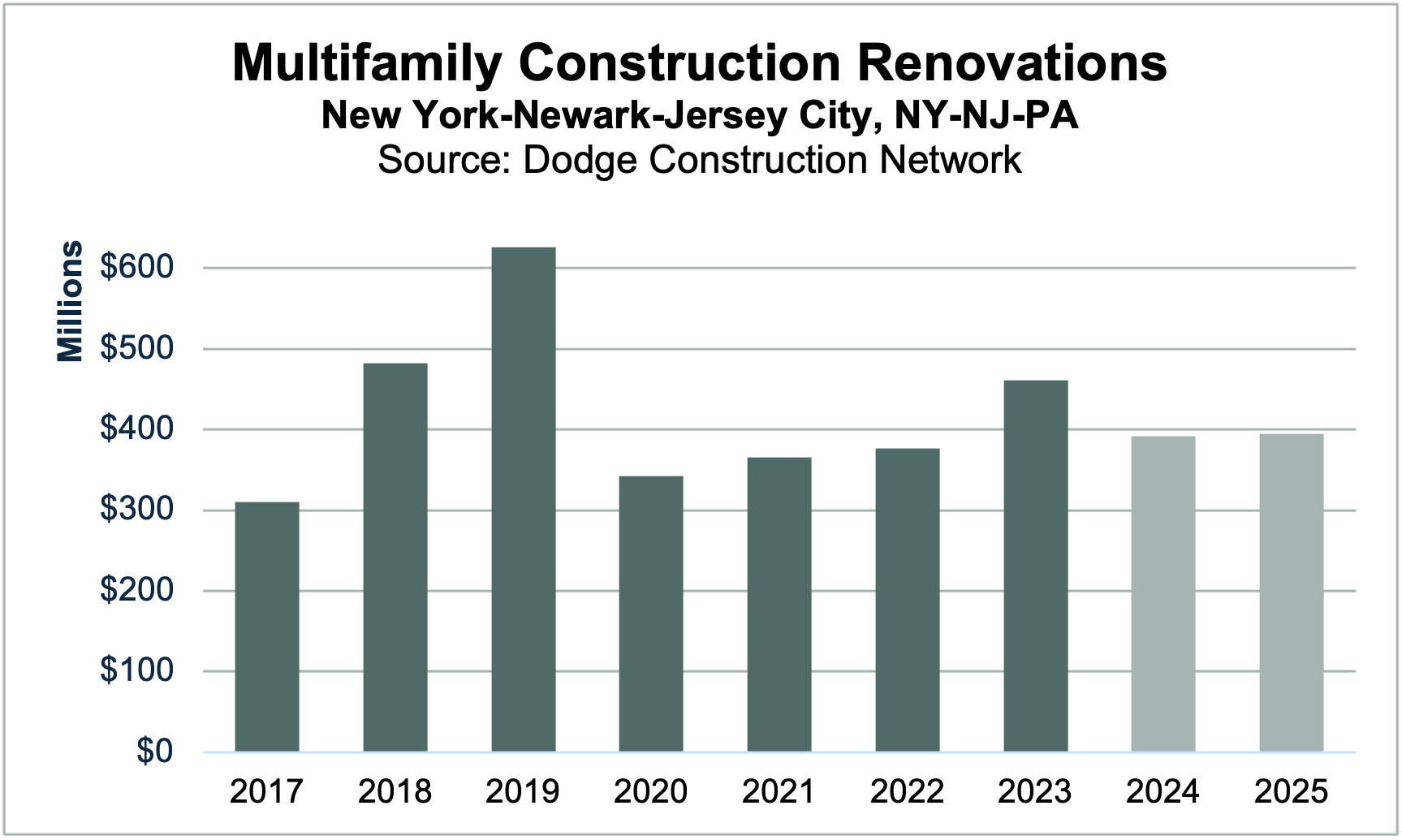

The value of construction renovations in NYC remained 26% below 2019 levels in 2023, although activity has been moderately rebounding in recent years. Some of this is likely driven by increased interest in converting empty office and hotel buildings into residential units.

According to Dodge’s project database, three office-to-residential conversion projects have entered the planning stage as of April 2024. If they succeed in reaching groundbreaking, these three projects could add around 1,500 new apartment units to the market. Overall, it’s quite costly and technically difficult to convert office buildings to residential units – but new tax incentives could provide more opportunity in this segment of the market. The value of total apartment renovations is expected to fall 15% in 2024 before ticking up 1% in 2025, according to the most recent Dodge Construction Network forecast.

New York’s housing market is poised for marginal improvements over the next year.

Dodge is currently assuming that the Fed will begin to lower interest rates in late 2024 – which should improve market conditions on both the demand and supply side of New York’s housing market by 2025. Lower interest rates will allow lenders to loosen standards and drive more investment activity back into the market. Meanwhile, rent and home prices will remain historically elevated – but will either grow at a slower pace or, in some boroughs, even decline. This will somewhat improve affordability for renters and sustain demand.

While affordability and supply of housing will continue to be a major issue in New York City for the time being, housing construction should see marginal improvements over the next year. Multifamily apartment units rose 29% from year-ago levels in the first quarter of 2024, while single family units improved 15% over the same period. In 2024, multifamily construction will recede another 15% before expanding more steadily in 2025 – alongside improved financial conditions.

<!-

<!-

References

Ariel Property Advisors. 2024. "Multifamily Year In Review New York City 2023."

Both, Alexandra. 2024. "Gen Z by Age 30: Renting Becomes the Go-To Housing Option With a Total Cost $145,000." RentCafe. 05 03. Accessed 05 04, 2024.

Bureau, U.S. Census, and NYS Office of the Comptroller. 2023. "NYC's Shifting Population: The Latest Statistics."

Census, U.S. 2023. Census.Gov QuickFacts.

Chaffin, Madison Darbyshire and Joshua. 2024. "Record number of cash offers show New York property is only for the rich." Financial Times. 03 05. Accessed 05 04, 2024.

Heidenry, Margaret. 2024. "See How Much You Need To Earn To Buy A Home in America's Top 50 Metros." Realtor.com. 05 02. Accessed 05 15, 2024.

NYC Comptroller. 2024. "Spotlight: New York City's Rental Housing Market." New York City.

NYC Department of Homeless Services; Local Law 79 Reports. 2024. Homelessness in New York City. New York City: Coalition for the Homeless.

Rogers, Jack. 2024. "Building Owners Bailing on Rent-Stabailized Apartments in NYC." Globest.com. 04 11. Accessed 05 15, 2024.

Sheidlower, Noah. 2024. "Meet the typical American moving to - and leaving - New York." Business Insider. 01 19. Accessed 05 04, 2024.

Shkury, Shimon. 2024. "New York City Housing Shortage Highlights Need for More Development." Shimon Shkury. 03 20. Accessed 05 10, 2024.

U.S. Census Bureau; City of New York. 2023. "2023 New York City Housing and Vacancy Survey."

U.S. Census Bureau; NYS Office of the Comptroller. 2023. "NYC's Shifting Population: The Latest Statistics."

Wall Street Journal. 2024. Homeless or Unhoused: Boomers are Stuck at Both Ends of the Housing Spectrum. May 09.