by Ralph Flores, Economist at Dodge Construction Network

In the latest release of the Producer Price Index (PPI) by the U.S. Bureau of Labor Statistics for August 2023, the numbers have ticked higher. After an increase of 0.4% in July, final demand prices moved ahead by 0.7% in August, marking the most substantial rise since June 2022. Over the past 12 months, the unadjusted index for final demand has risen by 1.6%. 80% of this upturn can be attributed to a 2.0% spike in the index for final demand goods, with energy prices leading the charge with a staggering 10.5% increase.

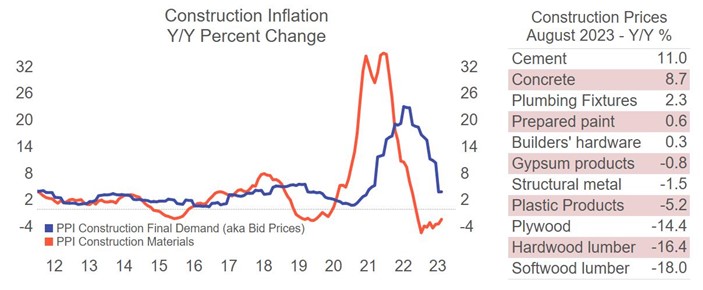

The construction sector is still grappling with rising material costs, but there are signs of resilience in the industry. Materials like lumber and structural metal have been able to offer a breather to the industry, even though cement (11%) and concrete (8.7%) have been stubbornly trending higher. Bid prices have been decelerating, but if raw material prices pick up speed that respite will prove to be temporary, which might pose challenges for the construction industry. Additionally, the surge in gasoline prices by 20.0% and the overall energy price spike is a cause for concern, as it could lead to increased transportation costs and higher prices for materials like roofing supplies and concrete.

The PPI data continues to highlight the vast undercurrents affecting the industry. Weakness in private verticals like office and warehouse are putting downward pressure on demand for materials, and therefore prices. However, manufacturing and infrastructure are doing the opposite. The end result is that inflation will remain a persistent issue for the industry for the foreseeable future.