by Arsene Aka, Senior Economist at Dodge Construction Network

This article provides evidence of increased retail construction starts in suburban and nonmetropolitan areas starting in 2022. It also highlights that, in 2024, levels (square footage) of starts located in the West South Central region were above their pre-pandemic (2019) levels in both metro and nonmetro areas. Meanwhile, the East North Central region continued to see levels of starts that were below pre-pandemic levels in all metro/nonmetro locations.

Moving to the Suburbs

The COVID-19 pandemic took a sharp economic toll on the retail industry, as many stores closed. A notable exception to this trend, however, were grocery stores and pharmacies. The pandemic also brought about a shift in the way people live and work, prompting an exodus from urban to suburban areas. This shift increased the number of individuals working from home, altering the commuting landscape of the nation.

In 2022, the U.S. Census Bureau reported that the number of Americans primarily working from home tripled from about 6% in 2019 to 18% two years later. At 48% in 2021, the District of Columbia had the highest percentage of home-based workers among states and state equivalents, followed by Washington, Maryland, Colorado and Massachusetts (each state at around 24%). Remote work has remained strong since 2021: latest data from the Bureau of Labor Statistics (BLS) shows an increase in the number of people ages 16 and over who are either fully or partially remote from 19% in December 2022 to 23% in November 2024. However, the share of fully remote workers in the BLS survey is largely unchanged at about 10% – 11%.

While downtowns suffered losses in residents during and after the pandemic, suburban areas flourished. With an increasing number of individuals working remotely and putting down permanent roots in suburban locations, both demand for housing and residential construction starts rose strongly in these areas. In a recent note to clients, Dodge Construction Network reported that “total residential units were up 3% through the first eleven months of 2024. But, in large central metros (the most population-dense zip codes), residential starts were down 4% through November. In medium-sized (population 250K up to 1 million) and in smaller metros, housing starts were up 2% and 16%, respectively. Robust growth of 15-16% has also been occurring in nonmetropolitan zip codes.”

Growth in residential construction starts accelerated sharply in 2021, as both metro and nonmetro areas saw double-digit increases in starts. With residential starts increasing in the suburbs, the demand for new retail space also picked up, albeit with a year lag (i.e., beginning in 2022). Even luxury retail, which used to be primarily for the urban crowd before the pandemic, is increasingly migrating into suburban locations to meet customers where they are. Urban retail continues to struggle due to suburban migration, remote work, the rise in e-commerce, high property crimes, reduced foot traffic, and low office utilization rates in major cities. According to real estate firm CBRE, urban retail availability surpassed suburban availability in the second half of 2022 for the first time since 2006.

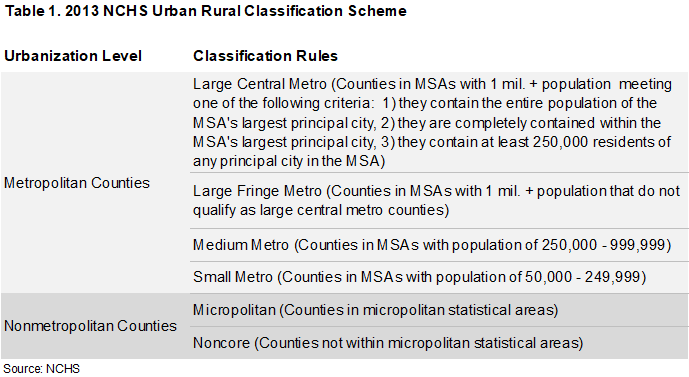

To assess whether retail building starts have lately been expanding faster in areas away from dense urban cores, this article made use of the urban–rural classification method developed by the National Center for Health Statistics (NCHS) in 2013. That classification, which can be seen from Table 1, groups counties from the most urban to the most rural (of note: large central metros are akin to inner cities and large fringe metros are akin to suburbs).

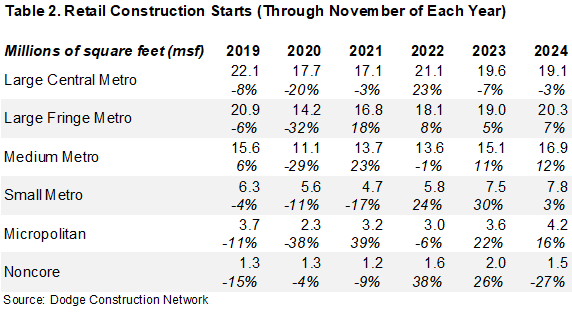

As can be seen in Table 2, which shows the change in the square footage of retail construction starts since the pandemic, starts declined in all metropolitan and nonmetropolitan areas in 2020, reflecting the impact of the COVID-19 pandemic (For Dodge the retail vertical consists of stores, shopping centers and food/beverage service). Retail construction buildings rebounded strongly in 2022, after residential starts grew strongly a year earlier. However, the two largest growth rates were posted in small metros (24%) and noncore nonmetropolitan locations (38%). Large central metros saw a 23% increase in starts during 2022, before posting successive declines in 2023 and 2024. On the other hand, retail starts continued to advance solidly in large fringe, medium-sized, small, and micropolitan nonmetro areas during both 2023 and 2024.

In 2024, the square footage of starts was 11% above the 2019 (pre-pandemic) level in nonmetro counties outside micropolitan statistical areas. Square footage stood above pre-pandemic levels by 23%, 15%, and 8% in small metros, micropolitan statistical areas, and medium-sized metros, respectively. Starts were still 3% below 2019 levels in large fringe metros and 14% below pre-pandemic levels in large central metros.

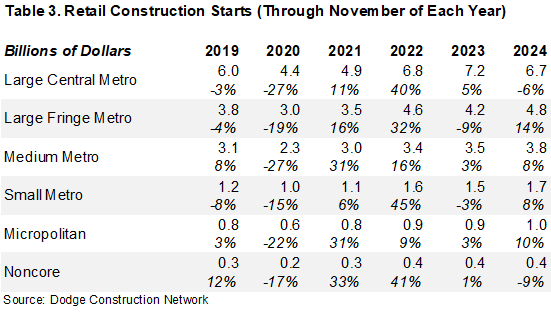

Table 3 shows changes in the dollar value of retail construction starts. Dollar value mirrored the same pattern seen for square footage during and immediately after the pandemic, with value rising in double digits in 2021-22. Following the strong advances, value rose more modestly in 2023-24. Except for large central metros and noncore nonmetro areas, the dollar value of starts increased between 2024 and 2022 in all metro and nonmetro locations.

Retail Starts are Thriving Away From Urban Cores in all U.S. Regions

In the last few years, the South region — which consists of the South Atlantic, West South Central and East South Central regions — has recorded rapid population growth, setting it apart from other regions such as the Northeast and Midwest, as people seek more space, warmer weather, and cheaper housing. As population rose in the South, so did the demand for more retail buildings.

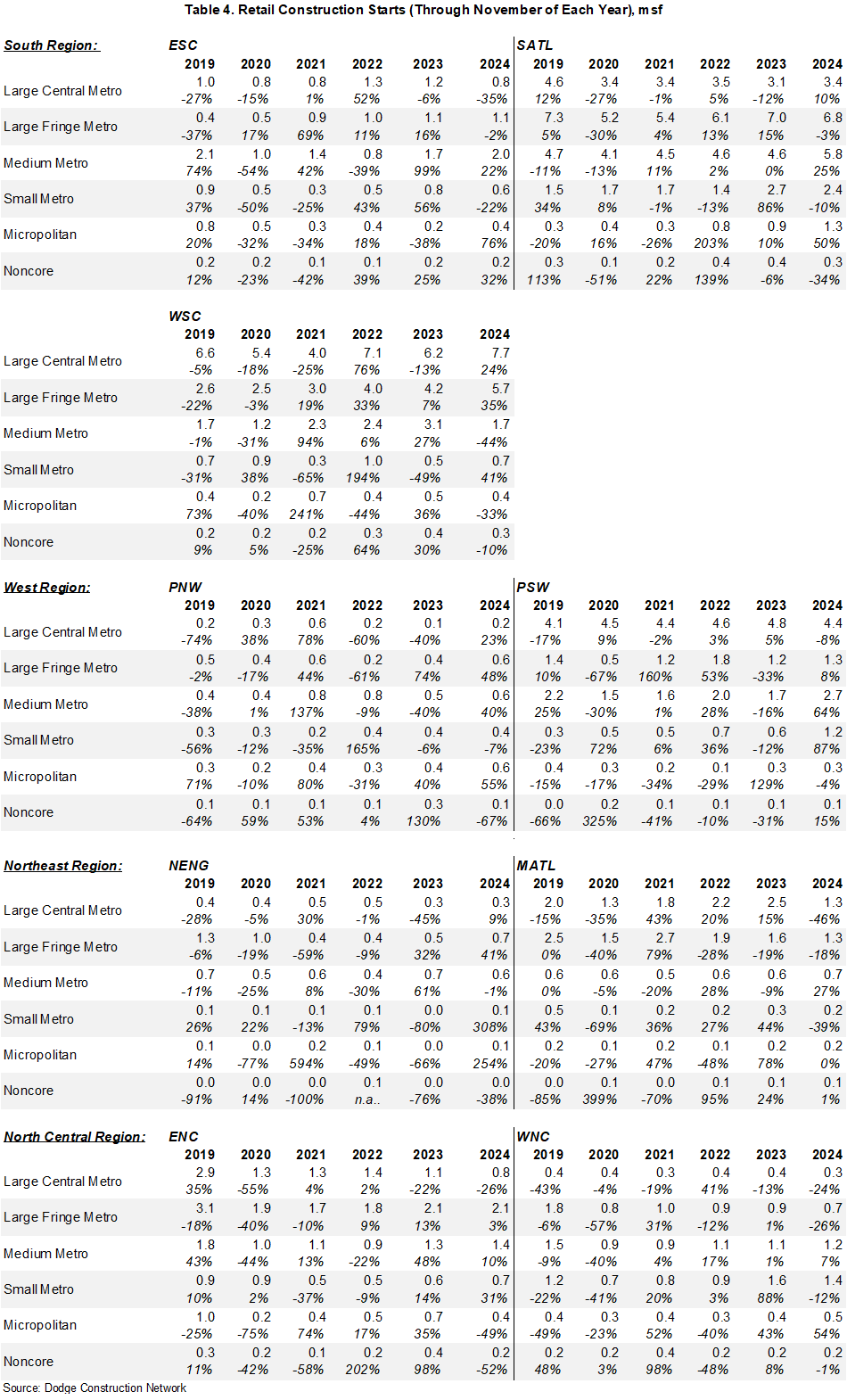

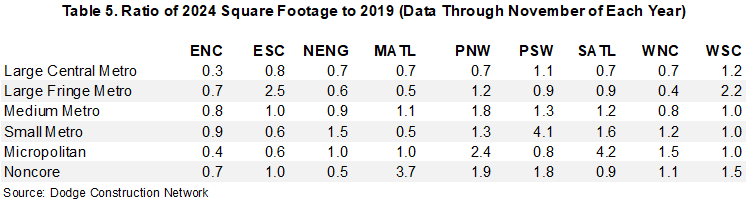

Table 4 shows that, for most regions, retail building starts have generally risen faster in small metropolitan and nonmetropolitan areas than in large and medium-sized metros since 2022. In addition, the square footage of retail starts in nonmetropolitan areas is higher in 2024 than in 2019 for counties located in the Pacific Northwest, West North Central, and West South Central regions (see Table 5). In particular, starts in noncore nonmetropolitan locations have more than doubled in the Middle Atlantic region since 2019, while starts in the South Atlantic and Pacific Northwest have more than doubled in micropolitan statistical areas during the same period.

Meanwhile, retail starts in large fringe and large central metros were generally above pre-pandemic levels in the West South Central, Pacific Southwest, Pacific Northwest and East South Central regions. On the other hand, starts in the East North Central region were below pre-pandemic levels in all locations. Starts in New England were also below pre-pandemic levels in all areas except for small metros and micropolitan statistical areas.

Remote work has undergone significant changes over the years, but hybrid work is expected to continue for the foreseeable future. As people live and work away from dense urban cores, retail construction starts could proliferate in small and medium-sized metros over the next two years.