by Arsene Aka, Senior Economist at Dodge Construction Network

Despite recent mixed economic news, the Canadian economy is poised to rebound in 2025. This post describes the country’s macroeconomic outlook and its implications for the construction sector in 2024-25.

Recent Economic Developments Are Mixed

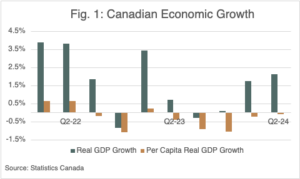

After contracting during the pandemic, the Canadian economy has yet to return to pre-pandemic trend. The pace of economic growth accelerated to a seasonally adjusted annual rate of 2.1% in the second quarter of 2024, from 1.8% three months earlier and a modicum 0.1% in the last quarter of 2023. In the second quarter, the economy was lifted by higher household spending on services, government consumption spending and business investment in structures. On the other hand, exports, residential construction and household spending on goods fell during the quarter. The combination of modest economic expansions and strong population growth has led to successive decreases in GDP per capita over the last several quarters. GDP per capita fell 0.1% in the second quarter, its fifth consecutive quarterly decline.

The Canadian economy is expected to advance at a moderate pace in the fourth quarter and will end 2024 at levels that are still below the pre-pandemic trend (Dodge Construction Network computed pre-pandemic trends using output data from Q1-2010 to Q1-2020). The output gap (i.e., the difference between current GDP levels and pre-pandemic trend) stood at 2% in the second quarter. Though the gap is smaller than the 4% posted in the second quarter of 2021, it has widened since second quarter 2022, suggesting strong headwinds (e.g., low productivity) on the road to recovery.

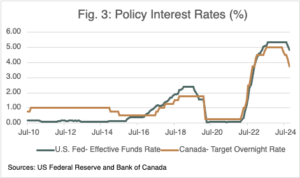

Because of potential impacts on investment flows between the two countries and their currencies, monetary policy from the Bank of Canada (BoC) and the U.S. Federal Reserve tend to move in lockstep. At the onset of the COVID-19 pandemic, the Fed delivered two large rate cuts at unscheduled emergency meetings in March 2020, lowering the federal funds target rate from 2.00% to the range of 0.00% – 0.25%. The Bank of Canada also moved three times that month to lower the target overnight rate to 0.25% and provide support to the economy. Two years later, both central banks began raising their key policy interest rates amid strengthening inflationary pressures.

In 2024, inflation began to ease in both countries and move closer to the central banks’ targets. This allowed the Bank of Canada to kick off the monetary easing cycle with a quarter-point reduction in June. The monetary authority further reduced its policy interest rate in July (25 basis points), September (25 bps) and October (50 bps). In total the Bank of Canada has lowered rates by 125 basis points since June. On the other hand, the U.S. Fed has cut its policy rate by 75 bps only once thus far in 2024.

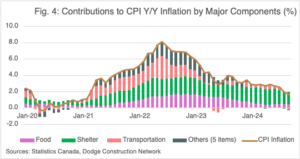

As noted, the rapid succession of rate cuts by the Bank of Canada has been facilitated by the strong moderation in inflation over the last several months. Inflation, as measured by the Consumer Price Index (CPI), has posted successive monthly declines since June 2024. Headline CPI inflation slowed in September to its smallest gain since February 2021. The CPI rose 1.6% year-over-year (y/y) in September on a not-seasonally-adjusted basis, down from 2% in August, on the back of lower gasoline prices. A year earlier, inflation was twice as high at 3.8% y/y. Rental prices—which account for 30% of the CPI basket—increased at a slower pace in September.

Meanwhile, the BoC’s preferred measures of core inflation (i.e., CPI-median and CPI-trim) were unchanged (on a y/y basis) from the previous month, advancing 2.3-2.4% y/y. Although they remain above the central bank’s inflation target of 2%, they represent a significant decline from the 2.8-2.9% y/y growth posted only four months earlier. As can be seen from Figure 4, the contributions to inflation of all components of the CPI index (other than shelter) have decelerated markedly over the last several months.

The Canadian labor market has cooled noticeably over the past year, weighed down by high interest rates. As a result, job gains have been moderate in recent months, although they unexpectedly picked up in September 2024. In October, gains were again moderate at +14,500. Business, building and other support services (+29,000), accommodation and food services (+12,000) and educational services (+12,000) saw strong hiring in October.

On a regional basis, employment rose in Alberta (+13,000), British Columbia (+8,000), Quebec (+6,500), New Brunswick (+3,300), and Newfoundland and Labrador (+500). It decreased in the remaining five provinces (i.e., Prince Edward Island (-1,100), Manitoba (-1,300), Saskatchewan (-2,000), Nova Scotia (-2,100), and Ontario (-11,000)). The jobless rate was flat at 6.5% in October, following a decline of 0.1 percentage points in September. Youth unemployment rate remains very high, despite falling 0.7 percentage points to 12.8% in October.

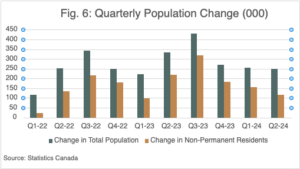

The stubbornly high jobless rate prevailing over the past few years is not surprising, given the rapidly increasing population. In the past two years, the population increase in Canada, which has boosted the labor force, has mostly stemmed from an increase in non-permanent residents, that is an increase in international students, asylum seekers, and temporary workers.

To curb the increase in non-permanent residents as well as ease the domestic housing shortage and pressures on health care, the federal government has recently announced various policy changes. In January, the government announced it would set a cap on study permit approvals for most applicants outside Canada for the years 2024 and 2025 to reduce international student numbers back to 2022 levels. In September, the authorities announced a further reduction of new international study permits for 2025-26, which now includes previously exempt master’s and doctoral students. According to an analysis by the Royal Bank of Canada (RBC), recent limits on international study permits will lead to an aging population over time, which in turn will lead to a declining labor force, lower federal and provincial government tax revenues, and higher healthcare costs and pension obligations.

Positive but Weak Macroeconomic Outlook

Inflation is expected to continue to moderate in the short term, as shelter price growth begins to slow and macroeconomic conditions remain soft. Dodge Construction Network expects inflation to decelerate in 2024 and 2025, averaging less than 2% in 2025, down from a rate of almost 4% in 2023.

Meanwhile, monetary policy is likely to ease next year. The Bank of Canada accelerated in October the pace of interest rate cuts with a 50-basis point reduction to the overnight rate to 3.75%. The monetary authority may lower interest rates by another 25 bps in December, should labor markets continue to be soft and economic growth continue to be moderate. Beginning next year Dodge expects the Bank of Canada to cut rates by 25 bps at alternating meetings until they reach a terminal equilibrium rate of 2.5% in late 2025. Given that risks to inflation look increasingly tilted to the downside of the central bank’s 2% target, an aggressive 50-bps interest rate cut cannot be ruled out at the next meeting.

As interest rates retreat, consumption will accelerate and lift GDP, which in turn will help boost hiring. The economy is expected to post below-trend growth of 1% for 2024 (Moody’s Analytics estimate) due to lagged effects of restrictive monetary policy. Though annualized growth reached almost 2% in the first half of 2024, third-quarter GDP growth is expected to be soft, tracking at an annualized rate of 1%, according to various commercial and investment banks. Dodge expects economic growth will accelerate to 1.9% in 2025, closer to the long-run potential output growth of 2%.

Despite recent curbs on non-permanent residents Dodge expects the robust labor supply growth will push the unemployment rate above 6% in both 2024 and 2025. Finally, Dodge expects the Canada-U.S. exchange rate to reach $1.32 CAD/USD this year before falling to $1.28 CAD/USD in 2025. Despite the anticipated appreciation against the U.S. dollar, the Canadian dollar is currently facing strong headwinds resulting from 1) wider interest rate differentials between the U.S. and Canada, which could lead to more investment inflows in the U.S., 2) lower crude oil exports from Canada to the U.S. when compared to 2023, and 3) trade uncertainties (i.e., potential higher tariffs) raised by the U.S. election (Canada sends the bulk of its exports to the United States.)

Residential Construction Poised to Recover

Factors that will impact the residential housing market in the short and medium terms include housing affordability, the recent curb on non-permanent residents, and fiscal and monetary policy.

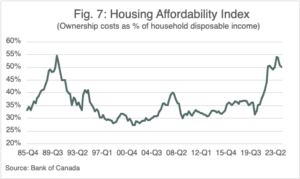

Data published by the Canadian Central Bank show that housing affordability—although remaining at its worst level in more than 25 years—has slightly improved in the nation over the past two quarters. Its housing affordability index measures the share of disposable income that a typical household would put toward housing-related expenses (in Figure 7, the late 1990s and early to mid-2000s represent periods of peak affordability). Housing affordability is anticipated to improve gradually overtime for the following reasons:

- Reduced cost of homeownership as a result of decreasing house prices, wage gains and continued rate cuts by the central bank.

- Bold mortgage reforms recently announced by the federal government. The government expanded eligibility for 30-year mortgage amortizations to all first-time homebuyers and to all buyers of new builds, effective December 15, 2024, a move that is intended to lower monthly payments. Moreover, the cap at which a buyer can qualify for an insured mortgage has been raised from $1 million to $1.5 million, providing additional support to homebuying.

Challenges facing the housing sector are also supply-related. In 2023 alone, the 263,000 new homes built in the nation pale in comparison of the 1.3 million increase in population (or more than 400,000 new households) that year. Recent estimates from the Canadian Mortgage and Housing Corporation (CMHC) put the housing gap at 3.5 million units from 2023 to 2030, with the largest gaps expected in Ontario (1.48 million), Quebec (0.86 million) and British Columbia (0.61 million). CMHC’s housing gap is in addition to housing units built under a baseline projection. Combining baseline projections and gap estimates, CMHC concluded that a total of 5.1 million units would be needed by 2030.

To ease the housing gap, the federal government released in its 2024 budget an ambitious agenda of building nearly 4 million new homes by 2031. The government hopes to boost housing supply by adopting various measures including:

- Building more homes on public lands and more apartment buildings,

- Converting underused federal offices,

- Taxing vacant lands to incentivize construction, and

- Removing the sales tax on new student residences.

This is an ambitious goal, given the severe labor shortage facing the construction industry. According to the Royal Bank of Canada, the nation might need more than 500,000 additional construction workers to build all the homes that will be needed by 2030.

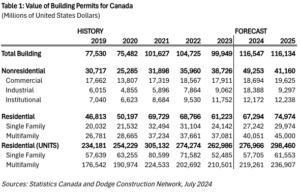

Overall, Dodge expects a rebound in residential permits in 2024-25: single-family permits are expected to grow following a large decline in 2023 on the back of declining affordability and higher mortgage rates. Multifamily permits are also expected to advance positively.

Manufacturing Sector to Peak This Year

Due to higher energy prices and demand, manufacturing permits (the largest component of industrial permits) surged in 2023. Manufacturing permits are expected to see a triple-digit increase in 2024 to a record-high level of $13.6 billion USD, driven by the start in April 2024 of a large chemical plant (the Dow Polyethylene and Ethylene Derivatives facility) in Alberta.

Thanks to subsidies from the governments of Canada, Alberta and Fort Saskatchewan, the Dow Polyethylene and Ethylene Derivatives facility will become the world’s first net-zero emissions integrated ethylene cracker and derivatives site. The Dow project, which was announced in late 2021, is expected to support 7,000 to 8,000 jobs during peak construction, according to the Alberta government. Following the record increase in 2024, manufacturing permits are predicted to fall in 2025 to levels closer to 2023, remaining well above levels seen in the prior five years. Not surprisingly, industrial permits follow the same pattern as manufacturing permits during the 2024-25 period.

Manufacturing construction will be supported in the short term by the “made-in-Canada plan” outlined in the 2023 federal budget. The plan, which provides tax incentives for zero-emission technology manufacturers and tax credits for clean technology manufacturing, is a response to the U.S. Inflation Reduction Act and aims at ensuring that Canada remains a top destination for business investment.

Commercial and Institutional Sectors to Grow Steadily

The commercial construction sector is well positioned to expand in the short term (2024-25), as the residential market rebounds, population growth remains elevated, and borrowing costs fall on the back of declining interest rates and improving lending standards. Dodge expects the sector to expand 4% in 2024 and 5% in 2025.

Several commercial verticals such as retail and office are anticipated to post robust growth: retail construction (as measured by trade and service permits) will benefit from lower interest rates and improving credit conditions. It is worth adding that e-commerce has accounted for less than 7% of total Canadian retail sales since June 2021, a share that is half that seen in the U.S. Meanwhile, the office market seems to have stabilized: according to a CBRE report for the third quarter of 2024, the office market is on track this year to report its first yearly positive net absorption total since 2019. While acknowledging the diverging trend between downtown (19.7%) and suburban (17.3%) vacancy rates, the report also notes that the national office vacancy rate has remained in a narrow 30 basis points range for the last six quarters. Finally, warehouse construction will be supported by the growing e-commerce and the resumption by Amazon to boost its presence in the nation.

The institutional sector is expected to expand 4% in 2024 and 1% in 2025, driven by the increase in educational permits for both years. The short and medium-term expectations for the education sector are relatively positive due to strong immigration in recent years and healthy demographic growth within Gen-Z, the current school-age population. Because of the Dow project and the rapid interest rate cuts, Dodge anticipates a rebound in total building to $117 billion USD in 2024. Total building is expected to be broadly unchanged in 2025.