Written by Robert Murray, Chief Economist on May 31, 2019

Construction Economics

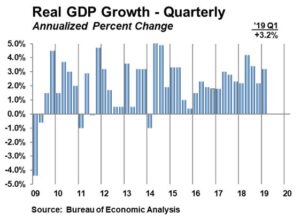

The U.S. economy grew at a surprisingly strong 3.2% in this year’s first quarter, according to the initial estimate from the Bureau of Economic Analysis. Last year had seen deceleration in the rate of GDP growth, sliding from 4.2% in the second quarter to 2.2% in the fourth quarter, and for various reasons it was believed that growth for this year’s first quarter would continue that decelerating trend. These reasons included the partial government shutdown, harsh winter weather, and the waning benefits from the 2018 tax cuts.

The first quarter GDP reading was boosted by several factors. Inventory investment by firms contributed 0.7% to the top-line GDP gain, compared to just 0.1% in the fourth quarter. Exports in the first quarter advanced 3.7%, while imports (for which increases count as a subtraction to GDP) fell 3.7%. And, state and local government spending registered a 3.9% hike in the first quarter, which was its strongest quarterly increase in the past three years.

At the same time, the first quarter GDP report included some cautionary points, even with the strong top-line number. Consumer spending, the largest GDP component, grew just 1.2% in the first quarter, compared to a 2.6% gain for all of 2018. Nonresidential fixed investment rose just 2.7% in the first quarter, compared to a 6.9% gain for all of 2018. The nonresidential fixed investment reading in the first quarter was pulled down by a 0.8% drop for nonresidential fixed investment in structures, which marked the third straight quarterly decline for this series. In addition, residential fixed investment in the first quarter dropped 2.8%, representing its fifth straight quarterly decline, as the recent lackluster performance by single family housing continues to restrain overall economic growth.

On balance, despite the healthy 3.2% gain in the first quarter, the most recent GDP report remains consistent with the sense that the U.S. economy is decelerating from the 2.9% rate of growth reported for 2018 as a whole. The first quarter lift coming from firms building up inventories is not likely to be repeated, and the same holds true for the lift coming from net exports as well as state and local government spending. Furthermore, the subdued readings for nonresidential fixed investment in structures and residential fixed investment are consistent with the picture of a construction economics expansion that at the very least is now in the process of leveling off.

Learn more about where the construction economy is headed with Dodge forecasting insight