by Arsene Aka, Senior Economist at Dodge Construction Network

The Bureau of Labor Statistics (BLS) reported that nonfarm payrolls rose by a seasonally adjusted 187,000 in July, almost matching June’s revised 185,000 gain. The unemployment rate fell to 3.5%, a rate not seen in more than 50 years, while growth in average hourly earnings remained unchanged in both June and July, at 4.4% year-over-year.

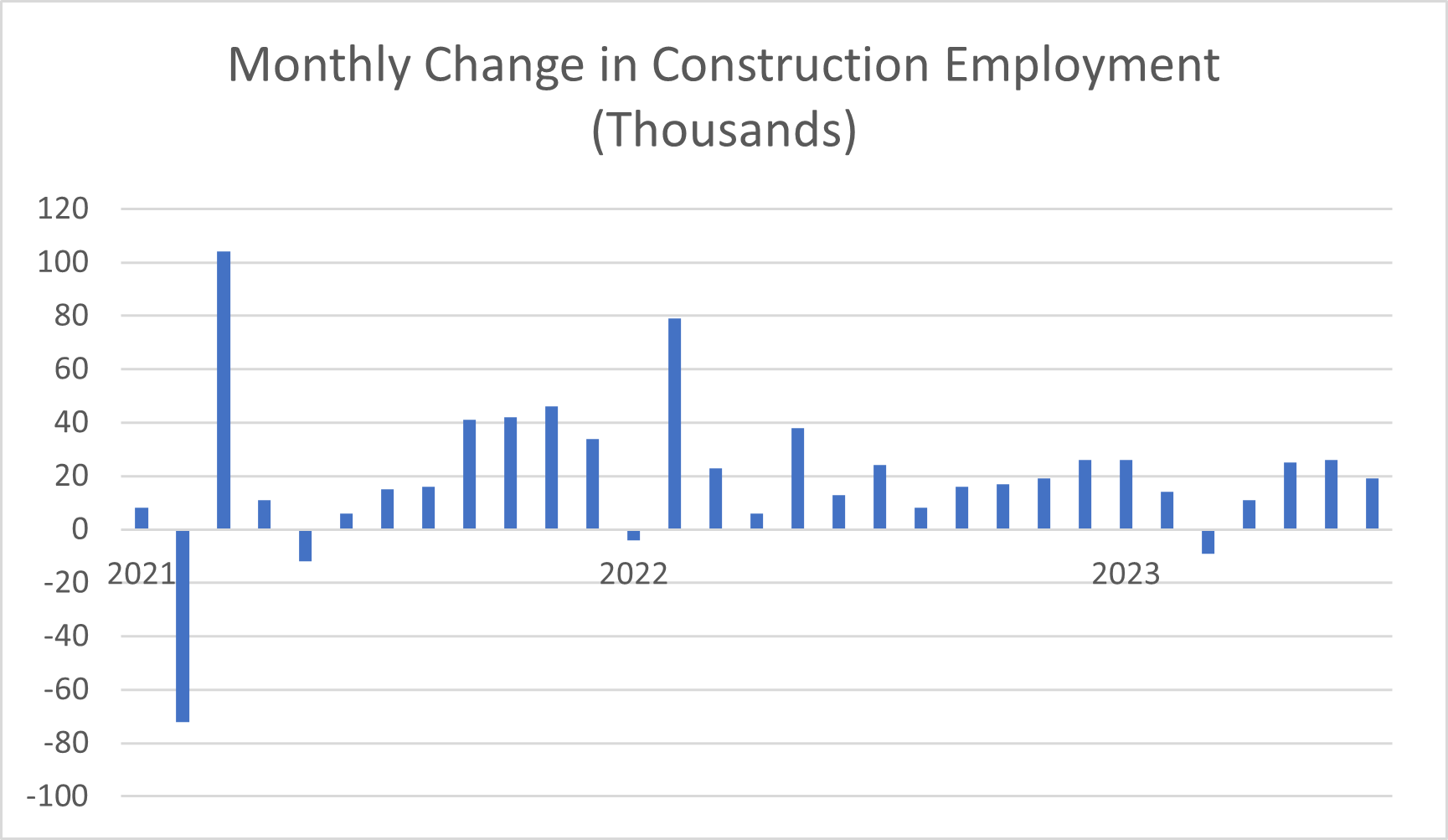

Employment in construction grew by 19,000 in July, almost in line with the average monthly gain of 17,000 recorded in the prior 12 months. Over the month, job gains occurred in residential specialty trade contractors (+13,300), nonresidential building construction (+10,500), and heavy and civil engineering construction (+2,200). On the other hand, job losses occurred in residential building construction (-5,500) and nonresidential specialty trade contractors (-2,100) between June and July.

The BLS report also showed that the jobless rate in the construction sector rose to 3.9% in July, from 3.6% in June. Meanwhile, the average hourly earnings were up 5.4% y/y in July, a full percentage point above the pace for the overall economy, highlighting supply shortages in the industry.

The gradually cooling labor market is not surprising given the Federal Reserve’s interest rate hikes since March 2022. Dodge Construction Network expects the Fed’s funds rate to remain unchanged in the remaining months of the year, and the July jobs report lends credence to the idea that a soft landing is still achievable. Even so, employment in interest sensitive construction verticals (such as residential and commercial) may be constrained in coming months, while employment in federally funded sectors such as manufacturing could expand more quickly.