by Arsene Aka, Senior Economist at Dodge Construction Network

Latest figures released by the Bureau of Labor Statistics (BLS) show a meaningful slowdown in U.S. payroll employment last month, as well as an uptick in the national jobless rate. Total nonfarm employment rose by 150,000 in October, falling below expectations for a 180,000 gain. The United Auto Workers strike against the Detroit automakers, which came to a full resolution earlier this week, were primarily responsible for the gap. The nation’s jobless rate rose to 3.9% in October, from 3.8% in the previous month. In addition, wage (i.e., average hourly earnings) grew 4.1% from a year ago, easing from 4.3% in September.

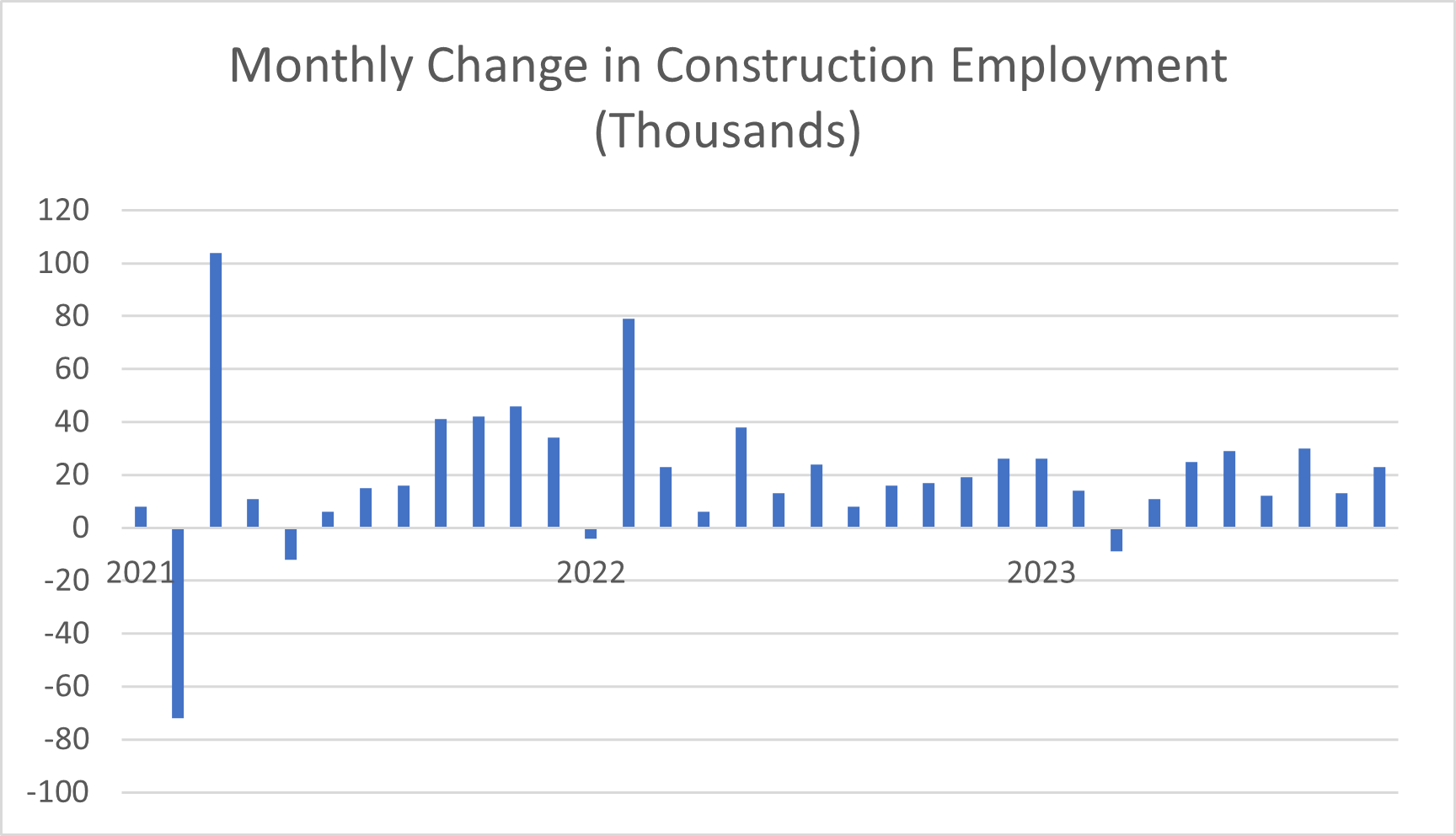

The BLS report shows that gains in construction employment remained strong, standing at 23,000 in October, up from 13,000 in September. Employment gains were broad based across all construction subsectors. Indeed, employment was up in specialty trade contractors (14,200), civil engineering construction (1,600) and construction of buildings (6,300). Despite the robust hiring, wage growth in the construction industry moderated last month, to a still very strong 5.0%.

Dodge Construction Network assumes that the Federal Reserve will keep its benchmark interest rate flat in December. The BLS report is consistent with this outlook, since the slowdown in hiring and wage growth could lead the Fed to extend its pause in interest rate increases. Following the BLS report, a CME Group gauge showed that markets have reduced the probability of a rate hike in December to less than 10%, from 20% a day earlier.