By Sarah Martin, Associate Forecasting Director

Since taking office, President Trump has rolled out a series of tariffs on imported goods, shaking up global trade dynamics and the U.S. economy. The following summarizes the recent changes to tariff policies and Dodge’s initial take on how the construction industry will be affected throughout this year.

In the 2025-Q1 forecast, Dodge assumed that the effective tariff rate in the U.S. would increase from 3% to 10% by the end of 2025, according to insights from Moody’s Analytics. As we begin to compile our preliminary assumptions around the next quarterly forecast, we now believe the trajectory of those tariff changes to be different. As of March 12th, the average U.S. trade-weighted tariff rate is already sitting at 8.1% (Wells Fargo). According to Moody’s Analytics, the effective tariff rate is now expected to peak in Q2-2025, versus the previously expected Q4-2025. Instead of reaching 10%, it’s broadly assumed that if all current and proposed tariffs are enacted this year, the effective tariff rate will reach 12%.

Here’s a summary of some of the latest tariff policy changes and consequent retaliatory tariffs (as of March 12, 2025):

- As of March 4th, the US has placed an additional 20% tariff on all imports from China. In return, China imposed a 15% tariff on select goods (including coal, LNG, and several food and animal products) and a 10% tariff on products like crude oil and agricultural machinery. They also plan to limit 15 U.S. companies from buying any Chinese goods without permission.

- As of March 4th, the US has placed a 25% tariff on all imports from Mexico, except goods covered by the USMCA – which face a 25% tariff on April 2nd. The US has also placed a 10% tariff on potash (fertilizer). Mexico plans to announce its retaliatory tariffs on April 2nd.

- As of March 4th, the US has placed a 25% tariff on all imports from Canada, except goods covered by the USMCA, which face a 25% tariff on April 2nd. The US has also placed a 10% tariff on energy products (e.g., crude oil and natural gas) and potash (fertilizer). As of March 4th, Canada had imposed initial retaliatory tariffs on $21 billion of US imports.

- As of March 4th, the Trump administration stated its intention to impose an extra 25% tariff on copper and lumber. This has not been enacted yet, and the start date is undetermined.

- As of March 12th, the US has placed a 25% tariff on all steel and aluminum imports. Consequently, Canada imposed tariffs on an additional $21 billion of US-imported goods, including steel and aluminum.

- As of February 26th, the US plans to place a 25% tariff on all goods from the European Union, but this has not yet taken effect or been finalized. As of March 12th, the EU announced tariffs on $28 billion of US goods beginning on April 1st.

- As of March 4th, President Trump stated his intention to impose reciprocal tariffs on any trading partners that put tariffs on US products, beginning on April 2nd. Although, experts say that it could take over six months for those changes to occur.

The most immediate risk to the construction industry will be to material prices. The U.S. construction industry will face higher input costs if producers are unable to find alternative products or inputs, pivot their supply chain, or receive an exemption on specific goods. Goods from Canada, Mexico, and China make up about 41% of US imports.

After stabilizing throughout much of 2024, input costs to construction remain roughly 40% higher than February 2020, according to the Bureau of Labor Statistics. In contrast to tariff increases back in 2018/19, producers and consumers have a limited ability to absorb further price increases in this already high inflationary environment. This would also disproportionately affect small and medium-sized businesses, which have less bandwidth to absorb those higher costs. Strong demand for construction in both residential and non-residential markets will also keep an upward pressure on prices this year.

Steel and aluminum prices: According to the U.S. Department of Commerce, the US imports about 40% of its aluminum and 25% of its steel from Canada, and another 12% of its steel from Mexico. As of March 12th, the U.S. has placed a 25% tariff on all steel and aluminum imports coming into the country. In turn, Canada has retaliated with new tariffs on a cumulative $42 billion of U.S. goods – including steel and aluminum.

Major U.S. steel mills and aluminum smelters could stand to benefit from tariffs as demand shifts domestically, and they can directly increase their prices. However, manufacturers who purchase their products will be confronted with higher costs. Steel and aluminum have widespread downstream uses in the construction industry – with applications in an array of building types, bridges, tunnels, rail lines, and within building products (appliances, electrical components, machinery, etc.).

Back in 2018, when Trump imposed a 25% tariff on steel and a 10% tariff on aluminum imports, we largely saw this play out. Domestic steel production increased by 6 million tons when comparing 2017 to 2019, and aluminum production increased by 350,000 tons. But the construction industry, along with the manufacturing and transportation sectors, faced higher input costs and slower growth, according to a study done by the Federal Reserve in 2019. This time around, tariffs are more broad-based than in 2018 – as they are set to affect both the raw materials and finished products. As a result, there’s a greater risk that construction projects in the planning stages could be further delayed or cancelled – as owners and developers grow concerned over uncertain pricing and potential supply chain disruptions.

Projects have already been taking longer to work their way through the planning queue since the Covid-19 pandemic. According to Dodge Construction Network, the median number of months it takes for a nonresidential project (between $20-$500 million) to move through planning is 6.5 months longer in the first two months of 2025, on average, than in 2019.

Source: Dodge Construction Network

Automotive manufacturing costs: Cars and auto parts will also face a 25% tariff, but for now, they remain exempt until April 2nd. Dodge reported a 33% drop in the dollar value of manufacturing starts in 2024. This decline was strongly influenced by project delays and cancellations for electric vehicle plants & electric vehicle battery plants. The Inflation Reduction Act drove incentives for electric vehicles, but weaker consumer demand and labor shortages throughout last year caused automakers to shift their strategies around that segment of their business – ultimately delaying or canceling those projects.

Source: Dodge Construction Network

If higher tariffs are prolonged, automotive manufacturers (in both conventional and electric vehicle spaces) could see higher costs. It’s likely we’ll see further price increases for imported vehicles from Canada and Mexico (roughly 25% of vehicles sold in the U.S.) and for those assembled in the U.S. that require inputs from our neighbors. Auto parts sometimes cross the U.S. border several times, given the highly integrated nature of the North American supply chain. Canada and Mexico are also the largest sources of U.S. exports of car and auto parts. In the face of retaliatory tariffs from those countries, US automakers could experience decreased sales.

Semiconductor chip prices: Semiconductor facilities, on the other hand, have been strengthening manufacturing construction in recent years, thanks to incentives within the CHIPS and Science Act. Several are slated to break ground in 2025 and 2026. There’s potential for increased risk in this outlook – as this sector could also face sizable tariffs, but plans to increase tariffs on this sector have yet to be finalized

If tariffs are put in place, most of that immediate price burden would fall on U.S. manufacturers and lead to increased prices for the various US products that use them (automobiles, home appliances, electronics, medical technology, etc.). Domestic production of chips, however, could benefit in the longer term. The U.S. accounts for roughly 10% of the global semiconductor market (less so for advanced chips) – while Taiwan dominates global supply. It will take several years for the U.S. to build up its own supply – and it’s likely that most U.S. companies will still need to rely on foreign manufacturers for at least part of the chipmaking process for quite some time.

Residential materials: On March 1st, President Trump signed an Executive Order to investigate the effects on national security of timber and lumber imports. A similar Executive Order was signed on February 25th regarding copper imports. This increases the risk that the US will place further tariffs on these products in 2025, although these have yet to be finalized.

As a result, home builders could face higher costs on products including lumber, copper, gypsum, iron and steel. According to the National Association of Home Builders, more than 70% of US imports of softwood lumber & gypsum come from Canada and Mexico. The U.S. housing market is already undersupplied by roughly 1.2 million units (both single and multifamily) according to Dodge analysis. This could further impede the speed at which home builders are able to shore up that supply.

As builders face higher input costs and pass them down to the consumer, home buyers will likely be faced with higher home prices – further constraining affordability. Mortgage rates will also continue to hover between 6-7% this year.

Source: Dodge Construction Network

Macroeconomic Implications: Generally speaking, Dodge is still gaining visibility around the timing and breadth of tariffs and their ultimate impact on the economy and the construction industry. If tariffs are short-lived and primarily used as negotiation tactics with Canada and Mexico, the industry will be able to evade significant downside risk. In recent weeks, however, communication from the Trump administration has suggested that longer-term and more broad-based tariffs are a high priority.

As risk grows around increasing prices for consumers and producers, the risk will also increase, and overall inflation remains elevated. With inflation moving sideways in recent months, plus new concerns over higher tariffs and more restrictive immigration, Dodge is expecting that the Federal Reserve will largely keep rates where they are through most of 2025 before cutting rates by a collective 50 bps across September and December.

The rapid nature in which these policies are being changed also adds a lot of uncertainty and confusion into the market. The NFIB Small Business Optimism Index, for example, has been showing very high levels of uncertainty among small business owners. For four months in a row, the Index has remained above the prior 51-year average. As owners and developers weigh policy changes, it’s becoming more likely that they’ll hold off on any project decisions until there’s more clarity around policy decisions.

The most recent projections from Moody’s Analytics suggest that GDP will now expand by 1.9% in 2025 (versus the 2.2% we had previously assumed in our January forecast). A further deceleration of growth will take place in 2026. We continue to believe that the brunt of tariff policy changes will impact the construction industry as we move into late 2025/early 2026. However, the longer tariffs are in place, and the higher they go – the higher the chance that the construction industry is affected more imminently.

What about reshoring?

While some domestic manufacturers will benefit from higher tariffs – most manufacturers will face higher input costs and be more vulnerable to supply chain issues. As the United States diverts its supply chain away from other countries, we will need more domestic labor and more supply of these materials. However, given the current labor shortage in the construction industry, it will be difficult to find enough labor not only to build these manufacturing plants but also to staff them. Manufacturers also face costly upgrades to existing facilities and higher labor costs, if they choose to reshore their operations into the United States.

However, this is an upside risk to the forecast. If the Trump administration can enact policies that allow for more skilled workers to enter the country legally – and we are able to ramp up domestic production more quickly – it could support the industry. Given the time it takes to garner investment and build these plants, Dodge does not expect that to be the case in 2025.

Despite risks, construction will move forward.

While risks are mounting from a macroeconomic perspective in 2025, Dodge is still forecasting 10% growth in construction starts this year (based on our Q1-25 forecast; this does not include updated GDP and tariff assumptions). Thanks to strong growth in 2024, the US economy began 2025 on a strong footing. GDP grew at a solid 2.8% in 2024, inflation was nearing the Fed’s 2% target and unemployment remained at a comfortable 4%. When analyzing a broad number of indicators over the past 2-3 months, the economy has weakened but the chances of an economic recession remain relatively low.

Source: Dodge Construction Network

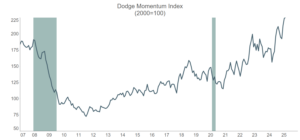

The Dodge Momentum Index, a key index that tracks the momentum of projects entering the planning queue, performed well in 2024. The DMI had an average reading last year that was 6% higher than the average reading in 2023. The DMI typically lags construction spending by about a year, indicating that there’s a strong pipeline of projects in the planning queue that could break ground in 2025 and 2026, if the economy remains strong.

The most vulnerable construction sectors will be within the residential and commercial real estate sectors. Homebuilders are already facing a severe housing shortage and high construction and labor costs, so further price increases and labor reductions could further constrain the construction of homes and apartments. Commercial real estate construction tends to be the most sensitive to changes in interest rates and capital. As interest rates stay higher for longer in 2025, it could deter some projects from being able to move forward.

However, mega-projects continue to account for a sizable amount of total construction – and will bolster activity in the short term. These projects are less interest-rate sensitive and have a higher chance of moving forward, given their funding from multi-national corporations. The sheer demand for data centers will keep that market afloat in 2025 as well. Publicly funded sectors, like education and healthcare, will prove to be more resilient thanks to strong state and local funding and demographic demand. Finally, infrastructure-related sectors are also forecast to remain sturdy, as funds from the Infrastructure Act remain influential in project activity through 2026.