Written by Richard Branch, Senior Economist on October 4, 2018

In mid-September, Hurricane Florence made landfall in the U.S. causing widespread damage and numerous deaths. At its peak, Florence reached Category 4 status before quickly easing in intensity to a Category 1 storm when it hit just south of Wrightsville Beach, NC. The intense rainfall associated with this storm, however, made the disaster particularly difficult.

In late September, Moody’s Analytics estimated the damage and economic impact from the storm in the range of $38 to $50 billion, making it one of the costliest Atlantic storms on record. Much of that damage will be to property – primarily to single family housing. By comparison, the damages caused by Hurricanes Katrina (2005) and Harvey (2017) were closer to $125 billion each. Regardless of the final dollar tally for Florence, the toll in human loss and suffering is incalculable.

When analyzing the impact of natural disasters, Dodge Data & Analytics has found that rarely are there spikes in construction starts during the months following the disaster. Rather, post hurricane construction starts tend to fall in the immediate aftermath of the storm, and only gradually increase in subsequent quarters.

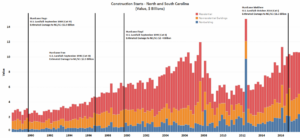

In the initial aftermath of a storm, the slowdown in hurricane construction starts reflects the focus on cleanup and damage assessment. Through the first eight months of 2018, the dollar value of construction starts in North and South Carolina was 2% higher than during the same period a year earlier, with starts forecast to be up 4% by year end. Given the slowdown that typically happens following a storm, however, the upcoming fourth quarter forecast is now likely to be lower.

Reconstruction efforts for residential buildings will likely be slow. How much and the pace at which rebuilding happens will be determined in large part by the number of homes with flood insurance and, for those without, whether federal disaster assistance will become available. Either way, insurance and federal disaster aid are generally slow to materialize. Further delay in rebuilding may be caused by the slow return of families who evacuated the area prior to the storm. The population of New Orleans, for example, has yet to return to its pre-Katrina level. Finally, the hurricane construction response in the residential sector will be difficult to measure since much of the construction associated with the recovery will be directed to renovations for single family housing, which are not included in the Dodge statistical database and are no longer available from the U.S. Census Bureau.

Infrastructure construction on the other hand, may be quicker to materialize due to extensive flooding in the affected area. Public works construction was 19% higher year-to-date through August in North and South Carolina, with activity likely to remain elevated in the coming quarters. Again, however, the speed of this hurricane construction will be largely determined by the pace of federal disaster assistance. A report by the Congressional Budget Office found that relief funds related to Superstorm Sandy were distributed very slowly. Even in 2018, Dodge Data & Analytics continued to record projects related to the 2012 storm.

Dodge will continue to assess the impact of Hurricane Florence in the coming months.