by Ralph Flores, Economist at Dodge Construction Network

In the latest PPI release by the U.S. Bureau of Labor Statistics for September 2023, final demand prices advanced by 0.5% after a 0.7% increase in August. Over the past 12 months, the unadjusted index for final demand increased by 2.2%, the most significant jump since April. The September surge was primarily driven by a 0.9% spike in prices for final demand goods, whereas final demand services saw a more modest increase of 0.3%.

Prices for final demand goods less foods, energy, and trade services increased by 0.2% for the fourth consecutive month, registering a 2.8% increase over the last 12 months. Breaking down the components of this PPI release, a significant portion of the increase in prices for final demand goods can be attributed to a 3.3% rise in energy prices, particularly gasoline, which surged by 5.4%. The recent surge in energy prices is unlikely to ease in the short term, primarily due to the ongoing conflict between Israel and Hamas, which has led to a sharp increase in global oil prices. Nevertheless, the exact impact of this conflict on energy prices remains uncertain, contingent on various factors like the duration and intensity of the war and its repercussions on oil-producing nations in the Middle East. While the situation is cause for concern, many experts are not anticipating a substantial or sustained hike in energy prices at this time. Furthermore, it’s essential to consider the seasonality of energy demand. With autumn’s arrival, demand for gas tends to diminish, which may serve to counterbalance potential price increments.

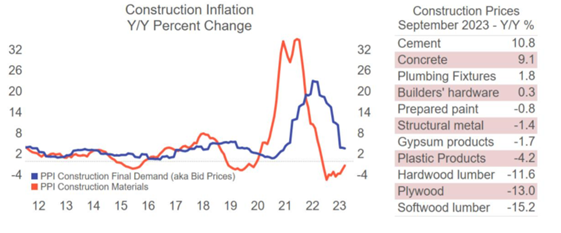

This release shows that inflation continues to moderate, which is encouraging as it suggests the Federal Reserve’s efforts to control inflation are working, further suggesting that the FED has concluded their interest rate hikes. While there are signs of resilience in the construction sector, with certain materials offering relief, others like cement and concrete continue to post higher prices. The construction industry remains at the crossroads as inflationary pressures persist albeit at a more modest pace than previous months. Looking ahead, it’s essential to keep in mind that the persistent rise in the PPI may result in increased expenses for both construction materials and labor, influencing the overall cost of construction projects as seen in the chart below.

Data source: https://www.bls.gov/ppi/