by Arsene Aka, Senior Economist at Dodge Construction Network

The September report released by the Bureau of Labor Statistics (BLS) far exceeded expectations, with U.S. payroll employment rising by 336,000, capping off 33 months of consecutive job gains. The nation’s jobless rate held steady at 3.8% last month. Meanwhile, wage (i.e., average hourly earnings) grew 4.2% year-on-year (y/y) in September, easing from 4.3% y/y in both August and July, as employers continue to compete for a limited pool of workers.

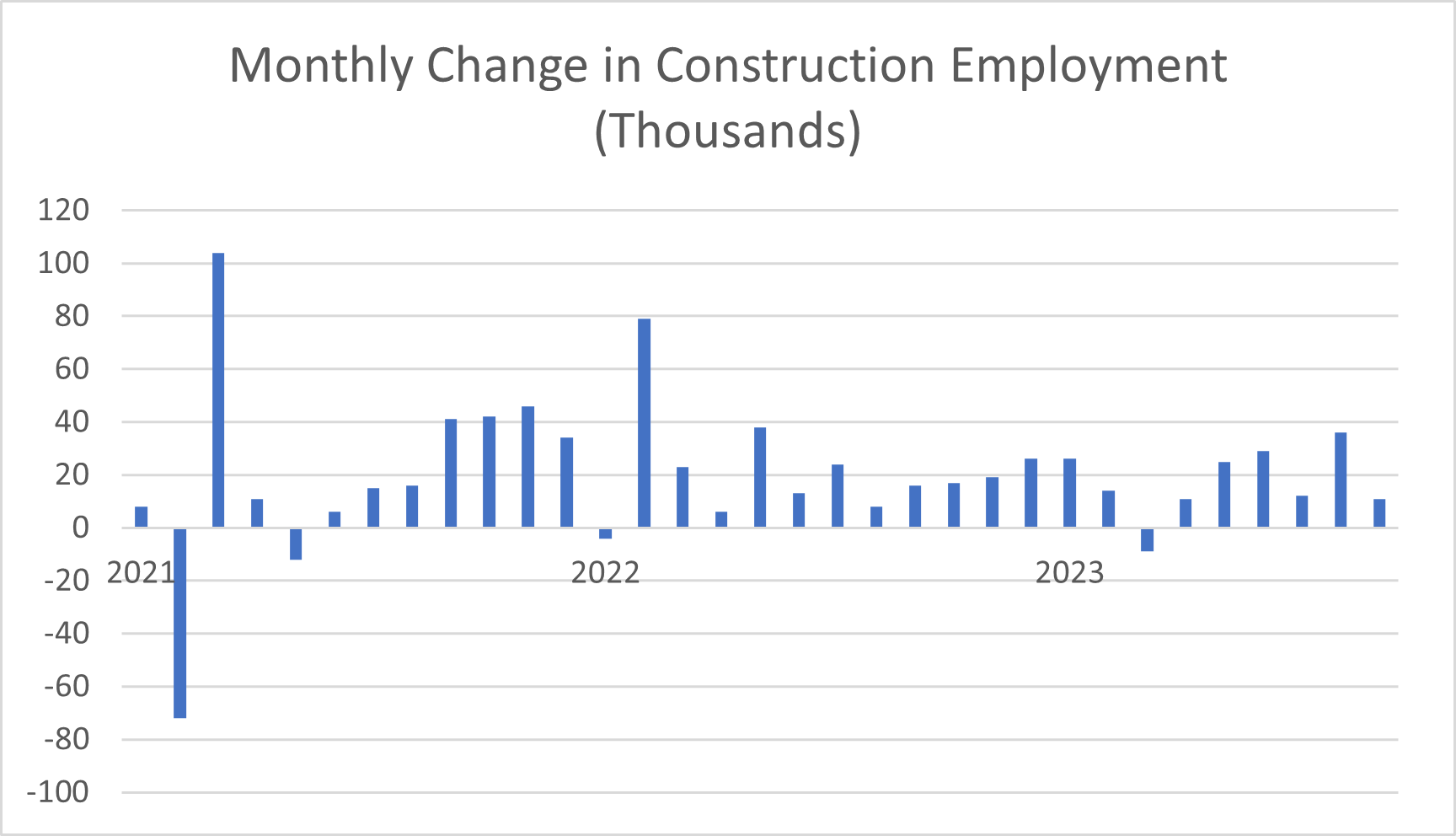

The BLS report shows that gains in construction employment fell from an upwardly revised 36,000 in August to 11,000 last month. Residential construction employment rose by 12,600 in September, lifted by robust monthly job gains in the residential building subsector. Meanwhile, employment in the nonresidential construction sector fell by 1,300. Heavy and civil engineering construction was the lone nonresidential subsector that posted a monthly increase in employment last month, as public monies continue to flow into infrastructure projects. Because of continued labor shortages and a high demand for workers, wage growth in the construction industry rose at a faster clip (+5.1% y/y) than the nation in September. The jobless rate in the construction industry dropped from 3.9% in August to 3.8% a month later.

Dodge Construction Network continues to assume that the Federal Reserve will keep its benchmark interest rate flat for the rest of this year. The BLS report is not inconsistent with our outlook, given that the nation’s wage growth eased last month despite considerably strong job growth. Should the inflation data that will be published this month and next show easing inflationary pressures, the Fed is likely to continue to keep rates unchanged. In addition, San Francisco Fed President Mary Daly recently pointed to the considerable tightening in the bond market as a justification for keeping rates flat at the next Fed meeting.

Data source: https://www.bls.gov/news.release/empsit.nr0.htm