by Ralph Flores

According to the U.S. Bureau of Labor Statistics’ latest release of the Producer Price Index (PPI) for July, the PPI for final demand experienced an increase of 0.3% from June, after being unchanged in June and declining 0.3% in May. Over the 12 months ending in July, the unadjusted index for final demand advanced 0.8%, reflecting a relatively steady inflation trend.

The index for final demand services took the lead in driving the overall increase, with a rise of 0.5%, while prices for final demand goods edged up 0.1%. This increase in service prices marked the largest jump since a 0.5% increase in August 2022. This increase is a punch toward the purchasing power of Americans. Notably, the prices for final demand services excluding trade, transportation, and warehousing displayed an increase of 0.3%. On the other hand, prices for final demand energy remained unchanged.

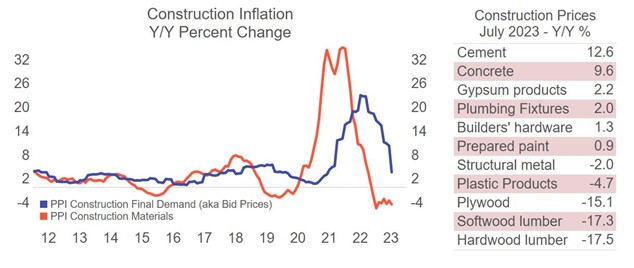

Inflation in non-food, non-energy final demand signals price increases for specific construction materials such as cement (12.6%), concrete (9.6%), and gypsum products (2.2%). If this upturn persists, it could potentially lead to an increase in bid prices in 2024, which might pose challenges for the construction industry. However, it’s worth noting that the lumber industry continues to exhibit a downward trend due to the weak single-family market, and now structural metal and plastic products are also experiencing deflationary pressures. The consistent downward trend is helping create a stable pricing environment for materials and services within the construction industry. Should this pattern persist, construction projects stand to gain from lowered expenses.

In summary, the July PPI release reveals an increase in final demand prices, primarily influenced by services. This notable increase in service prices has implications for inflation dynamics and justifies the Fed’s recent decision to increase rates last month. The construction industry, although benefiting from the improving global supply chain, will continue to grapple with the persistent upward trend in prices. While there are some signs of improvement, inflation remains a stubborn issue that requires careful management and strategic approaches from the Fed.