by Ralph Flores, Economist at Dodge Construction Network

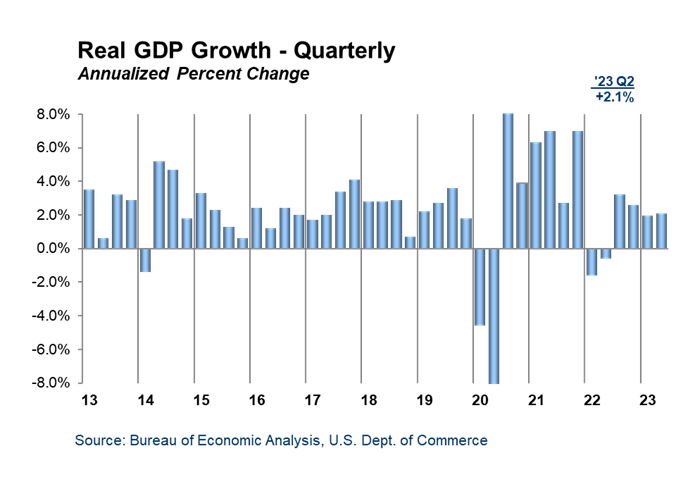

The Gross Domestic Product (GDP) report for the second quarter of 2023, just released by the Bureau of Economic Analysis (BEA), indicates an annualized growth rate of 2.1%, a slight downward revision from the previous estimate of 2.4%. Despite the revision, Q2 growth is still a slight increase from the annualized 2.0% growth observed in the first quarter.

The updated information primarily highlights reductions in private inventory investment, which are somewhat offset by positive revisions in state and local government expenditures. The updated GDP numbers demonstrate that the economy continues to expand, albeit at a somewhat slower pace than initially projected. Consumer spending, a vital driver of economic activity that accounts for around two-thirds of the economy, displayed resilience, increasing at a seasonally adjusted annual rate of 1.7% compared to the previous quarter. This change reflects upward adjustments in spending patterns for services like travel and entertainment, however durable goods were revised downward. Additionally, the personal saving rate edged up to 4.5%, indicating a slight increase in financial cushioning for households.

However, the quarter over quarter declines in investment and exports have the potential to affect future economic growth. The cautious stance displayed by businesses in their investments during the second quarter might be an indication of possible economic headwinds. This reduction in business investments, coupled with the downward trend in The Dodge Momentum Index (DMI) and sluggish construction starts, suggests a potential weakening in commercial activity due to stricter lending standards and higher interest rates. However, institutional activity should remain robust, supported by public funding and a reduced sensitivity to interest rate fluctuations. It’s important to note that this path is still in line with our expectations of a slowdown in the latter half of the year. To recap, while the GDP growth rate was revised downward to 2.1%, the overall trajectory remains positive, indicating continued economic expansion, although at a more tempered pace which could be encouraging to policymakers who have been seeking to cool down the economy.