by Sarah Martin, Associate Forecasting Director, and Olevia Sharbaugh, Economist

The construction of data center projects has been garnering a great deal of interest lately, alongside a cascade of high-value projects either entering the planning queue or reaching groundbreaking. The goal of this post is to break down the influence of data centers in the Dodge Momentum Index, a leading indicator of construction activity, and determine how we’re using that information to inform our data center construction starts forecast through 2025.

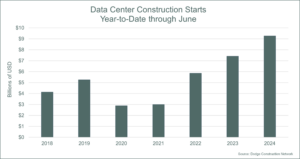

Data center construction starts have reached unprecedented levels in 2024.

Through the first six months of 2024, there have been a total of 78 data center projects that have begun construction. These projects totaled over $9 billion and almost 12 million square feet. Going all the way back to 2008, this is the largest value, area, and number of projects that data centers have ever seen in the first half of any given year.

These record numbers are largely due to the outstanding June that contributed $3.6 billion to the total for the year. A whopping 42% of that value comes from one project alone, the QTS New Albany 1 and 2 in New Albany, OH. This project is valued at $1.5 billion and consists of four separate data center buildings with an estimated 1.5 billion square feet of total data center space. This is the largest singular data center project Dodge has ever recorded as beginning construction since we began tracking the industry in 1967, but as the planning queue increasingly grows, $1.5 billion begins to seem modest by comparison.

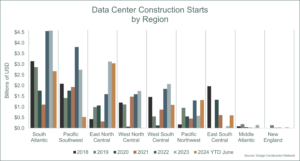

Given spatial and energy constraints, data center activity is regionally varied.

While the data center market is a great one for the United States as a whole, there are some areas that are experiencing the rush more than others. One region, in particular, that almost always ends up on top is the South Atlantic region. This large region includes many states such as Georgia, North Carolina, Florida, etc., however, the state that is single-handedly cementing this region as the clear winner of data center construction is Virginia. Since Dodge first began tracking the construction of data centers, Virginia has accounted for an astounding 71% of the total value and area of data center construction in the South Atlantic region. When broadening the scope to the entire United States, Virginia still holds 20% of the value (and 22% of the area) of all data center construction within its borders. So far this year, Virginia is holding its number one position, with 27% of all construction in the first half of the year occurring there.

Additionally, Ohio is close behind as it accounts for 22% of all data center construction through June 2024. With the help of Indiana, these two states have bumped the East North Central region into first place in terms of data center construction so far this year. Though Virginia remains the top state for now, the amount of large data centers expected to break ground by the end of this year in Ohio suggests that it will be a close race as to which state wins gold for data center construction in 2024. The reason behind the market’s partiality towards Virginia, Ohio, and even Texas could be the accessibility of power infrastructure, the lower cost or wider availability of land, or the competitive tax incentives offered by the states.

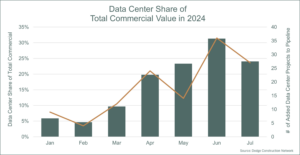

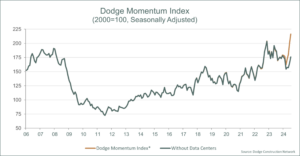

Data center planning is heavily influencing the commercial DMI.

The Dodge Momentum Index (DMI), a monthly measure of the value of nonresidential building projects going into planning (valued under $500 million), has surged in recent months – predominantly due to data center activity. Since January, the commercial portion of the Index has climbed a whopping 42%.

Back in January, data center planning only accounted for 5% of total commercial value. Over the last three months, however, that share has grown to 20-30%. From a project count perspective, only 9 data center projects entered planning back in January, compared to 27 projects in July, with eleven valued between $100 million and $500 million.

The largest data center projects to enter planning last month were the $483 million Microsoft SAT82 Data Center in Texas and the $480 million Yorkville Data Center Campus in Illinois. Not surprisingly, these two projects were also ranked as the highest-value projects that entered planning across all nonresidential sectors in July.

If we were to remove all data center projects that have entered planning so far in 2024, the Dodge Momentum Index would be down 6% from year-ago levels in July and the commercial portion of the Index would be flat (rather than up 35%, as it currently is). Strong demand for cloud and AI infrastructure is driving a lot of investment into the data center market – causing owners to push a slew of projects into the queue, especially as uncertainty wanes around 2025 market conditions.

Temporarily putting aside data centers, activity amidst the remaining commercial sectors has also shown promise. Planning projects across hotels, retail, warehouses, and parking garages were relatively stable throughout early 2024 – and have been gaining momentum since May. This is encouraging for commercial construction – as growth is becoming more diversified, and not solely centered around the growth of one sector. As it becomes increasingly likely that the Fed will cut rates in September, more commercial projects will continue to enter planning in the back half of 2024, ultimately reaching groundbreaking by mid-to-late 2025.

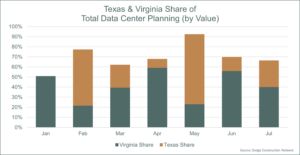

Texas and Virginia house the majority of data center projects in the project pipeline.

When analyzing the regional variations of projects in the planning queue, Texas and Virginia have dominated planning activity in the Dodge Momentum Index through July 2024. On average, 42% of the value of the data center projects that entered planning so far in 2024 was in Virginia, and another 28% was located in Texas.

In recent months, the East North Central region has accounted for 20-25% of data center dollar value as well – following an uptick in activity within Indiana, Illinois and Ohio.

Overall, as we look to next year, the recent growth in the data center portion of the Dodge Momentum Index will drive further growth in data center starts in 2025. Since planning activity typically leads construction spending by about 12 months, accelerated growth in this sector in mid-to-late 2025 will be strongly informed by the planning activity we’re seeing now.

The future is bright for data centers.

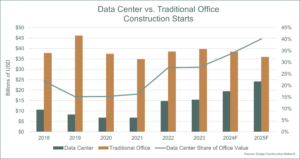

The future of data center construction is just as bright as the present. Even after the extensive growth that the category has already experienced over the past few years, demand for cloud and AI infrastructure will drive the sector to expand 26% in 2024 and 24% in 2025, ending the year at $24 billion.

Dodge tracks data centers in the office construction category, and though traditional offices are in decline as work-from-home and other market trends continue to push office vacancy rates up, data centers are expected to continue growing at a decent pace throughout our forecast period. While they only accounted for 15% of the total value of the office category in 2019, data centers will jump to 40% by 2025 and hover around that percentage throughout the end of the forecast. As artificial intelligence and cloud computing become a part of the everyday life of the average American, there will be no lack of demand for data centers moving forward.

To stay ahead of the curve, follow Dodge Construction Network on LinkedIn for the latest updates and insights on data center construction.