by Ralph Flores, Economist at Dodge Construction Network

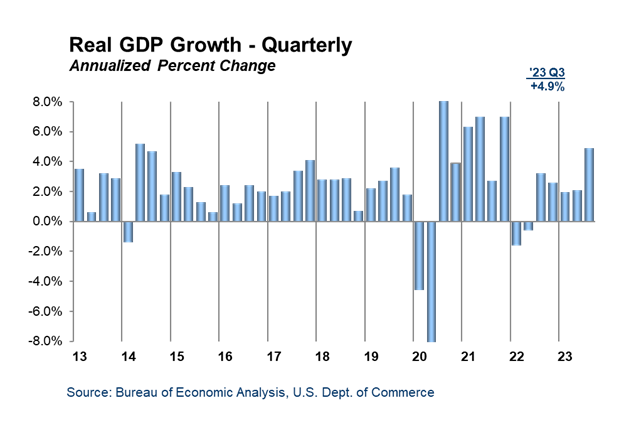

The “advance” GDP estimate for the third quarter of 2023, released by the Bureau of Economic Analysis (BEA), shows a strong performance for the U.S. economy. Real GDP increased at an annualized rate of 4.9%, more than double the 2.1% in the second quarter, marking the fastest pace since 2021. The third-quarter growth was broad-based, with increases in consumer spending, private inventory investment, exports, state and local government spending, federal government spending, and residential fixed investment, partially offset by a decrease in nonresidential fixed investment and an increase in imports.

Consumer spending, a key driver of economic activity, remained robust, showing strength in both services and goods despite the Federal Reserve’s efforts to slow the economy through high-interest rates. Private inventory investment experienced growth, particularly in manufacturing and retail trade. Certain sectors, like manufacturing in the construction industry, benefited from the overall economic acceleration. While personal income increased, disposable personal income in the third quarter rose less, leading to a decrease in real disposable personal income, suggesting pressure on real incomes. Personal saving also declined, leading to a drop in the personal saving rate to 3.8%.

The price index for gross domestic purchases, an indicator of the inflation rate for goods and services, rose by 3.0% in the third quarter, up from 1.4% in the previous quarter. Essentially, this suggests consumer goods and services became slightly more expensive. The Federal Reserve’s key inflation rate hasn’t decreased and remains reasonably stable, implying inflation isn’t spiraling too fast. However, to keep inflation in check, the Federal Reserve might need to maintain higher interest rates for a longer period than currently expected. This action could inflate borrowing costs for construction companies, possibly reducing the demand for construction projects in the upcoming months, leading to a sluggish Q4 in 2023 and a potentially flat Q1 in 2024.

The current trajectory aligns with our projections of a slowdown in the tail-end of the year through mid-2024. This situation, along with a slowing Dodge Momentum Index (DMI) and sluggish construction starts, points to a possible decline in commercial activity due to tighter lending standards and increased interest rates. Nonetheless, institutional activity is expected to stay strong, thanks to public funding and its lesser sensitivity to interest rate changes. It’s important to note that this latest data release is an “advance” estimate and is subject to further revision. A more complete “second” estimate for the third quarter will be released on November 29, 2023.