Nonbuilding Starts Led This Month’s Decline

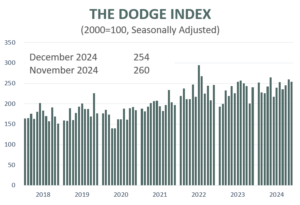

BOSTON, MA — January 21, 2024 — Total construction starts decreased 2% in December to a seasonally adjusted annual rate of $1.2 trillion, according to Dodge Construction Network. Nonresidential building starts grew 2%, nonbuilding starts moved 14% lower, while residential building starts grew 4%. On a year-to-date basis through December, total construction starts were up 6% from 2023. Nonresidential starts were up 4%, residential starts were up 7% and nonbuilding starts were up by 7%.

For the 12 months ending December 2024, total construction starts were up 6% from the 12 months ending December 2023. Residential starts were up 7%, nonresidential starts were up 4% and nonbuilding starts rose 7% over the same period.

“Rate cuts prior to December supported some momentum in multifamily and commercial starts over the month,” stated Sarah Martin, associate director of forecasting at Dodge Construction Network. “Sustained labor shortages and elevated materials prices will continue to add risk to the sector, in addition to the concern over tariffs and more strict immigration enforcement. Overall, the strength in the value of projects in planning and further Fed rate cuts should encourage growth in construction in 2025.”

Nonbuilding

Nonbuilding construction declined 14% in December to a seasonally adjusted annual rate of $322 billion. Environmental public works starts receded 18%, while utility/gas starts moved 1% higher, and miscellaneous nonbuilding starts fell 36%. Highway and bridge starts dropped 5% in December. In 2024, total nonbuilding starts were 7% higher when compared to a year ago. Miscellaneous nonbuilding starts were up 26%, environmental public works starts were 24% higher, and highway and bridge starts improved by 6%, but utility/gas starts were down 14% through December.

The largest nonbuilding projects to break ground in December were the $740 million Donald C. Tillman Advanced Water Purification Facility in Los Angeles, California, the $650 million Pulaski Solar Farm (405 MW) in Karnak, Illinois, and the $483 million Kelso Solar Farm (349 MW) in Blodgett, Missouri.

Nonresidential

Nonresidential building starts rose 2% in December to a seasonally adjusted annual rate of $482 billion. Commercial starts were 6% higher during the month thanks to an increase in data center, hotel, and retail starts, while institutional starts fell 3%. Manufacturing starts rose 19% over the month. In 2024, total nonresidential starts were up 4%. Institutional starts were 16% higher, while commercial starts were up 8%, and manufacturing starts were 35% lower on a year-to-date basis through December.

The largest nonresidential building projects to break ground in December were the $1.6 billion Lyndon B. Johnson Hospital Replacement in Houston, Texas, the $1.2 billion San Antonio International Airport Terminal C Development in San Antonio, Texas and the $1.1 billion Hard Rock Hotel in Las Vegas, Nevada.

Residential

Residential building starts grew 4% in December to a seasonally adjusted annual rate of $397 billion. Single-family starts fell 3%, while multifamily starts were up 24%. In 2024, total residential starts were 7% higher. Single-family starts increased 15%, and multifamily starts were down 7% on a year-to-date basis through December.

The largest multifamily structures to break ground in December were the $510 million St. Regis Residences development in Miami, Florida, the $350 million Reflections Lakeside Resort in Orlando, Florida and the $210 million Ritz-Carlton Residences in The Woodlands, Texas.

Regionally, total construction starts in December rose in the Midwest and South Atlantic regions, but fell in the Northeast, South Central, and West regions.