The start of three megaprojects failed to overcome broad-based weakness

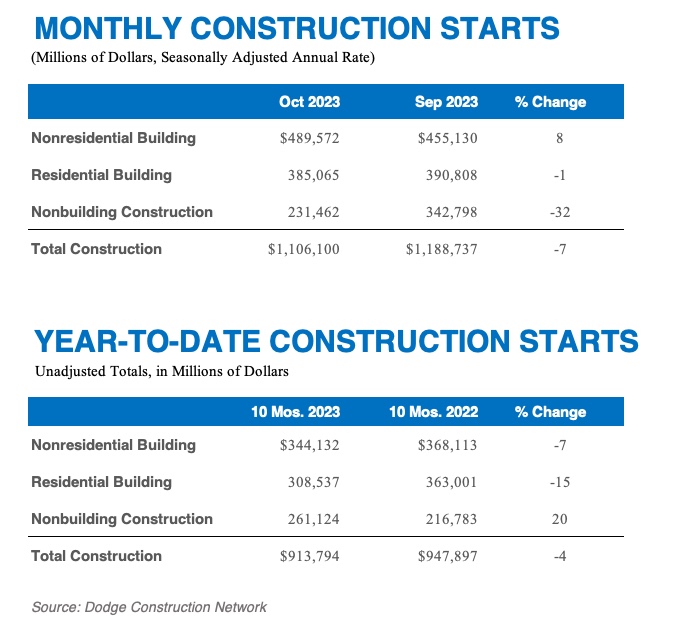

HAMILTON, N.J. – November 21, 2023 — Total construction starts fell 7% in October to a seasonally adjusted annual rate of $1.1 trillion, according to Dodge Construction Network. Nonbuilding and residential starts fell 32% and 1%, respectively. Conversely, nonresidential building starts gained 8% during the month.

Year-to-date through October 2023, total construction starts were 4% below that of 2022. Residential and nonresidential starts were down 15% and 7%, respectively; however, nonbuilding starts were up 20%. For the 12 months ending October 2023, total construction starts were down 1%. Nonbuilding starts were 22% higher, and nonresidential building starts gained 1%. On a 12-month rolling basis, residential starts posted a 15% decline.

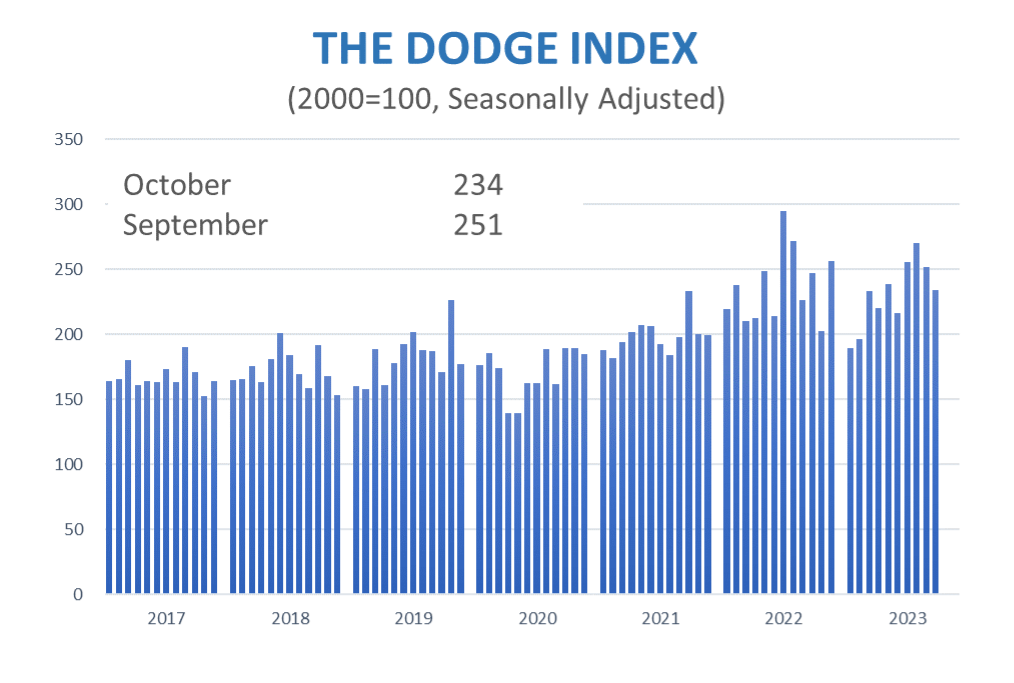

“Construction starts have weakened over the last two months as high interest rates and tight credit have restrained activity,” said Richard Branch, chief economist for Dodge Construction Network. “While it seems likely that the Federal Reserve will hold off raising rates further, it will take time until they consider easing. This will likely result in a continued softening in construction starts over the next several months.”

Nonbuilding

Nonbuilding construction starts lost 32% in October, falling to a seasonally-adjusted $231 billion. A decline in utility/gas starts drove category starts to a 12-month low. Miscellaneous nonbuilding stars dropped 20%, and environmental starts were 15% lower. However, highway and bridge starts improved 6% in October. Year-to-date through October, nonbuilding starts were up 20% overall. Utility/gas plants rose 52%, and miscellaneous nonbuilding starts increased 18%. Highway and bridge starts gained 9%, and environmental public works rose 13%.

For the past 12 months ending in October 2023, total nonbuilding starts were 22% higher than in the 12 months ending in October 2022. Utility/gas plant and miscellaneous nonbuilding starts rose 56% and 15%, respectively. Highway and bridge starts were up 11% and environmental public works starts were 15% higher on a

12-month rolling sum basis. Overall, the success in nonbuilding starts prevented further declines in the overall monthly starts values.

The largest nonbuilding projects to break ground in October were the $319 million Newton-Weston bridge replacement in Newton, Massachusetts, the $300 million Cadence Solar Center in York Township, Ohio, and the $280 million Estonian Solar project in Cooper, Texas.

Nonresidential

Nonresidential building starts rose 8% in October to a seasonally adjusted annual rate of $490 billion. The increase was led by the groundbreaking of several very large manufacturing plants during the month. If not for those plants total commercial starts would have lost 28%. Commercial starts dropped 18% during the month due to a very sharp pullback in office activity, while institutional starts fell 15%, despite a solid gain in healthcare starts. Year-to-date through October, total nonresidential starts were 7% lower than that of 2022. Institutional starts gained 4%, while commercial and manufacturing starts fell 10% and 20%, respectively.

For the past 12 months ending in October 2023, total nonresidential building starts were 1% higher than that ending October 2022. Manufacturing starts were 2% higher, institutional starts improved by 5%, and commercial starts lost 4%.

The largest nonresidential building projects to break ground in October were the $7.5 billion Micron semiconductor fabrication facility in Boise, Idaho, the $2.2 billion Hyundai/LG EV battery plant in Ellabell, Georgia, and the $1.5 billion Nucor Sheet Mill in Apple Grove, West Virginia.

Residential

Residential building starts fell 1% in October to a seasonally adjusted annual rate of $385 billion. Single family starts lost 2%, while multifamily starts were flat. On a year-to-date basis through October 2023, total residential starts were down 15%. Single family starts dropped 17%, and multifamily starts were down 12%.

For the 12 months ending in October 2023, residential starts were 15% lower than in 2022. Single family starts were 20% lower, while multifamily starts were down 7% on a rolling 12-month basis.

The largest multifamily structures to break ground in October were the $364 million QPX mixed-use tower in Long Island City, New York, the $350 million mixed-use building on W37th Street in New York, New York, and the $225 million first phase of the Baccarat Residences in Miami, Florida.

Regionally, total construction starts in October fell in the Midwest, South Atlantic, South Central, and West regions, but rose in the Northeast.

Watch Chief Economist Richard Branch discuss October Construction Starts here.

October 2023 Construction Starts