Decline in utility starts powers total activity lower; residential starts continue upward momentum

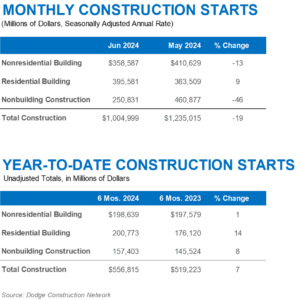

BEDFORD, MA —July 23, 2024 — Total construction starts lost 19% in June, falling to a seasonally adjusted annual rate of $1.0 trillion, according to Dodge Construction Network. Much of the decline was due to a stark decline in utility/gas starts following a strong May that saw several megaprojects get underway. During the month, nonbuilding starts fell 46% (following a 49% gain in May), while nonresidential starts fell 13%. Residential starts rose 9% during the month. On a year-to-date basis through June, total construction starts were up 7% from the first six months of 2023. Residential starts were up 14%, while nonbuilding starts gained 8%, and nonresidential building starts rose 1%.

For the 12 months ending June 2024, total construction starts were up 1% from the 12 months ending June 2023. Nonresidential building starts were down 7%, residential starts were up 7%, and nonbuilding starts were up 8% on a 12-month rolling sum basis.

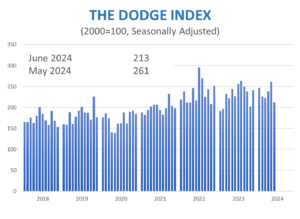

“The construction market remains sluggish as high interest rates continue to reverberate through the sector,” said Richard Branch, chief economist of Dodge Construction Network. “However, the Dodge Momentum Index, which tracks nonresidential building projects entering the planning phase, has been reasonably steady over the last year indicating that owners and developers remain cautiously optimistic that the conditions will be more conducive to construction in the future. But moribund starts activity means that these projects are piling up like water behind a dam. Lower rates in 2024 will allow these projects to start flowing again, resulting in a quicker pace of activity towards year-end.”

Nonbuilding

Nonbuilding construction starts fell 46% from May to June to a seasonally adjusted annual rate of $251 billion. This drop follows a large increase in May when both an LNG plant and an offshore wind project got underway. As a result of that payback, gas/utility plants fell 90% over the month, while environmental public works lost 4%. Highway and bridge starts gained 5% in June and miscellaneous nonbuilding starts rose 28%. On a year-to-date basis through June total nonbuilding starts were 8% higher. Environmental public works starts were up 20%, gas/utility starts were up 16%, highway and bridge starts rose 1%, and miscellaneous nonbuilding starts were down 2% through June.

For the 12 months ending June 2024, total nonbuilding starts were 8% higher than the 12 months ending June 2023. Utility/gas starts were up 23%, environmental public works starts improved 12%, while highway and bridge starts were even, and miscellaneous nonbuilding starts lost 6% for the 12 months ending June 2024.

The largest nonbuilding projects to break ground in June were the $510 million Airo Ivy City Yard rail improvements in Washington, D.C., the $400 million Cadillac El Dorado Solar facility in Callahan County, Texas, and the $400 million replacement of the Belmont Park racing facility in Elmont, NY.

Nonresidential

Nonresidential building starts lost 13% in June to a seasonally adjusted annual rate of $359 billion. Manufacturing starts tumbled 34%, while institutional starts retreated 19%. On the plus side, commercial starts rose 4% in June due to an increase in office and data center activity along with increased retail starts. On a year-to-date basis through June, total nonresidential starts were up 1%. Institutional starts were 11% higher, while commercial starts were down 3%, and manufacturing starts were 19% lower on a year-to-date basis through June.

For the 12 months ending June 2024, nonresidential building starts were 7% lower than the previous 12 months. Manufacturing starts were down 33% and commercial starts were down 9%, while institutional starts were 8% higher for the 12 months ending June 2024.

The largest nonresidential building projects to break ground in June were the $1.5 billion QTS Albany 1 & 2 data centers in New Albany, Ohio, the $550 million First Solar manufacturing plant in New Iberia, Louisiana, and the $520 million TGH Taneja Tower Surgical building in Tampa, Florida.

Residential

Residential building starts moved 9% higher in June to a seasonally adjusted annual rate of $396 billion. Multifamily starts rose 23%, while single-family starts gained 4%. On a year-to-date basis through six months, total residential starts were 14% higher. Single-family starts improved 25%, and multifamily starts were 6% lower on a year-to-date basis.

For the 12 months ending June 2024, residential starts were 7% higher than the previous 12 months. Single-family starts were 17% higher, while multifamily starts were 7% lower on a 12-month rolling sum basis.

The largest multifamily structures to break ground in June were the $1 billion Bentley Residences in Sunny Isles Beach, Florida, the $600 million Cipriani Residences in Miami, Florida, and the $434 million The Marketplace apartments in Irvine, California.

Regionally, total construction starts in June fell in all regions.