Substantial growth in data center planning drives commercial momentum

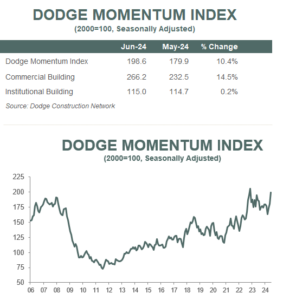

BEDFORD, M.A. – July 9, 2024 — The Dodge Momentum Index (DMI), issued by Dodge Construction Network, increased by 10.4% in June to 198.6 (2000=100) from the revised May reading of 179.9. Over the month, commercial planning increased 14.5% and institutional planning ticked up 0.2%.

“Data centers continued to dominate planning projects in June – fueling another strong month for commercial planning,” stated Sarah Martin, associate director of forecasting at Dodge Construction Network. “More momentum in planning, while not as strong as data centers, was seen across most segments and indicates confidence in 2025 market conditions. The DMI is up 43% from June 2019 levels, signaling strong construction spending in 2025.”

Data center planning continued to be the primary driver of commercial growth in June, alongside moderate growth in retail, hotels, and warehouse projects. On the institutional side, weaker healthcare planning was offset by an improvement in education activity. Additionally, a large detention facility entered the queue last month and bolstered public planning as well.

In June, the DMI was 7% higher than in June of 2023. The commercial segment was up 25% from year-ago levels, while the institutional segment was down 25% over the same period.

A total of 38 projects valued at $100 million or more entered planning throughout June. The largest commercial projects included the $420 million Oaklawn Land Bay A Data Center in Leesburg, Virginia, and the $400 million PowerHouse Irving Data Center in Irving, Texas. The most significant institutional projects to enter planning were the $305 million Horizon Juvenile Center Annex in Woodstock, New York, and the $285 million research and development buildings in San Diego, California.

The DMI is a monthly measure of the value of nonresidential building projects going into planning, shown to lead construction spending for nonresidential buildings by a full year.