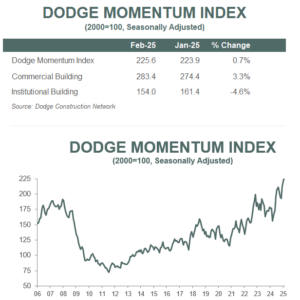

Planning activity flattens over the month.

BOSTON, M.A. – March 12, 2025 — The Dodge Momentum Index (DMI), issued by Dodge Construction Network, grew 0.7% in February to 225.6 (2000=100) from the revised January reading of 223.9. Over the month, commercial planning increased 3.3% while institutional planning fell 4.6%.

“Planning momentum moderated in February, after a few months of stronger growth,” stated Sarah Martin, associate director of forecasting at Dodge Construction Network. “Data centers continue to prop up growth in the overall index. Without them, the DMI would have decreased 2% this month. Increased uncertainty around material prices and fiscal policies may begin to weigh on planning decisions, but for the time being, planning activity is largely continuing to move forward.”

On the commercial side, data center, traditional office building, and retail planning led this month’s gains, while weaker education planning brought down the institutional portion. In February, the DMI was up 27% when compared to year-ago levels. The commercial segment was up 43% from February 2024, while the institutional segment was up 2% over the same period. The influence of data centers on the DMI this year remains substantial. If we remove all data center projects between 2023 and 2025, commercial planning would be up 12% from year-ago levels, and the entire DMI would be up 8%.

A total of 26 projects valued at $100 million or more entered planning throughout February. The largest commercial projects included the $500 million Tract Data Center Park in Chester, Virginia, and the SAT93 and SAT94 Microsoft Data Center projects in San Antonio, Texas – each valued at $350 million. The largest institutional projects to enter planning were the $329 million Burlington High School in Burlington, Massachusetts, the $300 million T-Mobile Arena renovation in Las Vegas, Nevada, and the $300 million North Dakota State Hospital in Jamestown, North Dakota.

The DMI is a monthly measure of the value of nonresidential building projects going into planning, shown to lead construction spending for nonresidential buildings by a full year.