Slower planning across several segments drove weaker activity this month.

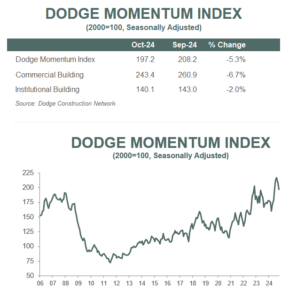

BEDFORD, M.A. – November 7, 2024 — The Dodge Momentum Index (DMI), issued by Dodge Construction Network, decreased 5.3% in October to 197.2 (2000=100) from the revised September reading of 208.2. Over the month, commercial planning fell 6.7%, and institutional planning declined 2.0%.

“In addition to data center planning normalizing, a moderate pullback in the number of planning projects for several other nonresidential sectors also contributed to the decline in the Dodge Momentum Index for October,” stated Sarah Martin, associate director of forecasting at Dodge Construction Network. “Regardless, owners and developers remain confident in next year’s market conditions, and the planning queue remains poised to spur stronger construction activity in 2025, following deeper rate cuts by the Fed.”

Most commercial categories faced declines throughout October, aside from hotel planning – which continued to gain momentum. On the institutional side, education and public planning activity expanded, offset by weaker activity in healthcare, recreational, and religious projects.

This month, the DMI was 13% higher than in October of 2023. The commercial segment was up 18% from year-ago levels, while the institutional segment was up 3% over the same period. The influence of data centers on the DMI this year has been substantial. If we remove all data center projects from January to October, commercial planning would be down 4% from year-ago levels, and the entire DMI would be down 2%.

A total of 18 projects valued at $100 million or more entered planning throughout October. The largest commercial projects included $450 million EdgeCloudLink Data Center in Houston, Texas and the $410 million GFT Hotel in Arlington, Texas. The largest institutional projects to enter planning were the $300 million Kellogg School Building at Northwestern University and the $270 million Primrose School of Stevens Ranch in San Antonio, Texas.

The DMI is a monthly measure of the value of nonresidential building projects going into planning, shown to lead construction spending for nonresidential buildings by a full year.