Commercial and multifamily starts nudged higher in 2019

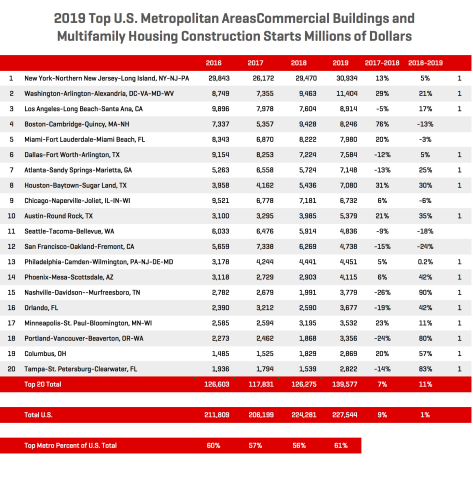

Commercial and multifamily starts in 2019 totaled $227.5 billion nationwide, a 1% gain from the previous year.

But the 20 largest metros saw an 11% increase to $139.6 billion according to Dodge Data & Analytics. There was an 8% increase for the top 10 metros with seven of them posting double-digit gains.

While New York remained the largest market with $30.9 in starts, the growth of the market eased from 13% in 2018 to just 5% in 2019.

Multifamily starts fell 5% to $95.2 billion while commercial starts rose 7% to $132.3 billion. Commercial starts in the top 10 metro areas posted a much stronger gain, increasing 17% for the year against a 1% decline in multifamily starts.

“Commercial construction starts continue to be the bulwark of US construction activity as strong demand for office and warehouse buildings pushes the value of construction to higher levels,” stated Richard Branch, Chief Economist for Dodge Data & Analytics. “Multifamily starts, however, are past their peak and have entered cyclical decline.”

Branch says that the growing divide between the larger and smaller metro areas was stark in 2019.

“While commercial and multifamily starts in the top 20 metro areas in the country moved 11% higher in 2019, those metros ranked 21-50 lost 7%,” he continued. “For 2020 multifamily construction starts are likely to continue lower as the declines broaden to more and more metropolitan areas. Meanwhile commercial starts have posted gains for nine consecutive years, but a slowing economy in 2020 will likely lead to fewer large value projects, causing national starts to pull back from their 2019 level.”