Both residential and nonresidential construction employment were up in June.

The Bureau of Labor Statistics (BLS) reported that nonfarm payrolls climbed by a seasonally adjusted 209,000 in June, falling below economists’ expectations. The unemployment rate fell to 3.6%, while the average hourly earnings rose 4.4% on a year-over-year (y/y) basis, up from 4.3% y/y in May.

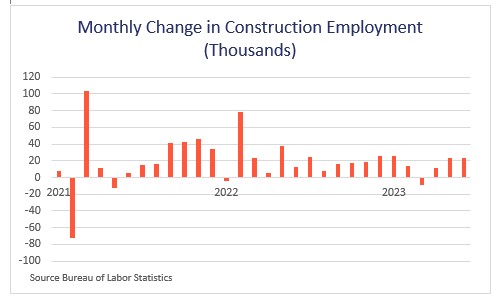

Employment in construction was up 23,000 in June. Thus far this year, construction has added a monthly average of 15,000 jobs. In June, residential specialty trade contractors posted the largest monthly increase in employment (+10,000), followed by employment in heavy and civil engineering construction (+7,300), nonresidential building construction (+5,400) and residential building construction (+800).

The consecutive monthly increase in residential building construction employment is an indication that single family home construction might be past the trough of the cycle and could show improvement in the second half of the year. The BLS report also shows that the average hourly earnings in construction were up 4.7% y/y in June, slightly faster than the pace for the overall economy. Significant pressure on construction wages should be expected over the next few months, as construction labor remains in short supply and job openings continue to ramp up.

Employment in construction was up 2.8% year-over-year in the first half of 2023, defying the higher interest rate environment. The BLS U.S. jobs report is still in line with another Federal Reserve rate hike at the July meeting. Higher interest rates for a longer period and tighter lending standards do not bode well for construction starts and employment over the next 12 months. In particular, commercial and income-property construction starts will be hardest hit.