Construction Starts Move Lower in January

Construction starts beginning the year lower across all major sectors

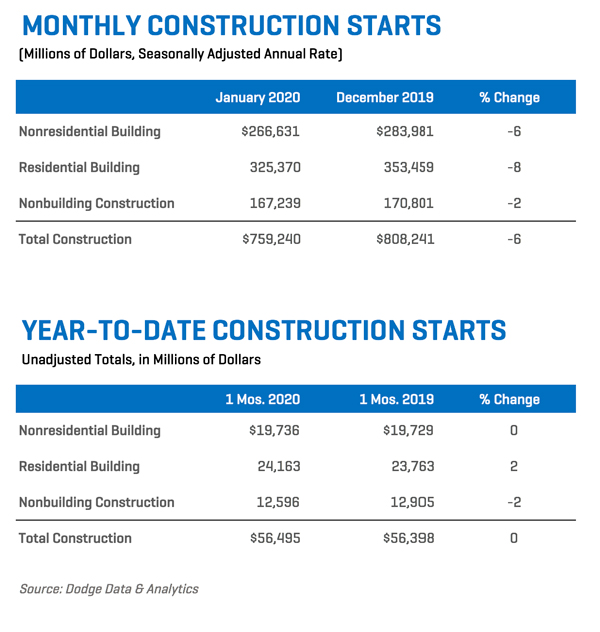

NEW JERSEY — February 18, 2020 — Total construction starts slipped 6% from December to January to a seasonally adjusted annual rate of $759.2 billion. All three major categories moved lower in January —residential building starts fell 8%, nonresidential building lost 6%, and nonbuilding starts moved 2% lower.

With only one, limited month of data available for 2020, it is difficult to ascribe a 2020 trend. Some perspective can be gleaned, however, by examining a 12-month moving total. For the 12 months ending January 2020, total construction starts were 1% higher than during the previous 12-month period. By major category, residential building starts were 1% lower and nonresidential building starts were down by less than a percentage point, but nonbuilding construction was 8% higher during the 12 months that ended in January 2020.

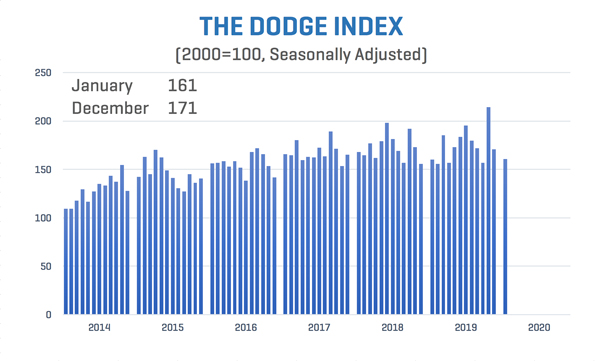

In January, the Dodge Index moved downward to 161 (2000=100) compared to the 171 posted in December 2019 and was 8% lower than its most recent 12-month average.

“Coming in slightly weaker than the previous month, January’s starts did little to change our view that construction starts will remain near their recent highs in 2020 even though they are likely to fall as the economy slows,” stated Richard Branch, Chief Economist of Dodge Data and Analytics.

Nonbuilding construction starts moved 2% lower in January, falling to a seasonally adjusted annual rate of $167.2 billion. In January, gains were seen in highways and bridges as well as miscellaneous nonbuilding categories, which moved up 15% and 12% respectively. Meanwhile, the utility/gas plant and the environmental public works sectors both pulled back, falling 29% and 10%.

The largest nonbuilding construction project to break ground in January was the $705 million extension of the South Central LRT in Phoenix AZ. Also starting in January was the $575 million Permian Energy Center solar project in Andrews county TX and the $550 million Wheatridge wind and solar project in Lexington OR.

For the twelve months ending January 2020, total nonbuilding starts were up 8% compared to the twelve months ending January 2019. On the plus side, environmental public works were up 4% and the utilities/gas plants were up an impressive 116%. Streets and bridge starts, however, were 8% lower and miscellaneous nonbuilding starts were down 19%.

Nonresidential building starts fell 6% in January to a seasonally adjusted annual rate of $266.6 billion. However, if not for the start of a large manufacturing project nonresidential building starts would have declined 11%. In January, manufacturing starts more than doubled, while commercial building starts slipped 16%, and institutional starts fell 6%.

The largest nonresidential building project to break ground in January was the $475 million Cree Semiconductor plant in Marcy NY. Also starting was the $476 million BMO Office Tower in Chicago IL and the $400 million Husky Superior refinery in Superior WI.

On a twelve-month total basis, total nonresidential building starts were less than one percentage point lower than they were in the twelve months ending in January 2019. Commercial starts were 5% higher, while institutional starts fell 3% and manufacturing starts were down 10%.

Residential building starts dropped 8% in January to a seasonally adjusted rate of $325.4 billion. During the month single family starts fell 5%, while multifamily starts lost 15%.

The largest multifamily structure to break ground during in January was the $300 million Liberty on the River Apartment Tower in Philadelphia PA. Also starting in January was a $260 million mixed-used building on 10th Avenue in New York NY as well as the $249 million Downtown Fifth Luxury Apartments in Miami FL.

For the 12 months ending in January, total residential starts were 1% lower than the previous 12 months. Single family starts gained 1%, but multifamily building starts were 5% lower.

###

About Dodge Construction Network Dodge Construction Network leverages an unmatched offering of data, analytics, and industry-spanning relationships to generate the most powerful source of information, knowledge, insights, and connections in the commercial construction industry. The company powers four longstanding and trusted industry solutions—Dodge Data & Analytics, The Blue Book Network, Sweets, and IMS—to connect the dots across the entire commercial construction ecosystem. Together, these solutions provide clear and actionable opportunities for both small teams and enterprise firms. Purpose-built to streamline the complicated, Dodge Construction Network ensures that construction professionals have the information they need to build successful businesses and thriving communities. With over a century of industry experience, Dodge Construction Network is the catalyst for modern commercial construction. To learn more, visit construction.com

Media Contact :

Cailey Henderson | 104 West Partners | cailey.henderson@104west.com