Higher employment in residential and nonresidential sectors leads to rebound

The Bureau of Labor Statistics reported that hiring in the US unexpectedly picked up last month, with employers adding 253,000 (seasonally adjusted) jobs, up from a revised 165,000 in March. The nation’s unemployment rate edged down to 3.4% in April, from 3.5% a month earlier and 3.6% in February, representing the lowest jobless rate since January.

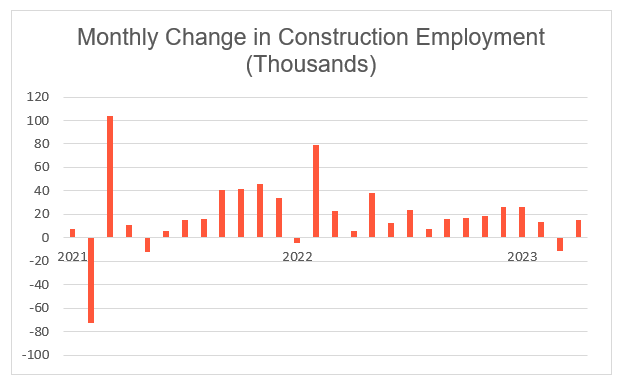

The construction industry added 15,000 (seasonally adjusted) jobs last month, rebounding from a loss of 11,000 jobs in March. Employment in both residential and nonresidential sectors rose by 14,200 and 800, respectively. Meanwhile, the construction unemployment rate declined from 5.6% in March to a still robust 4.1%, highlighting the persistent labor shortages in the industry.

Despite the increase in jobs, the outlook for construction employment remains uncertain. Tighter monetary policy and the recent banking turmoil have added to the downside risks for the industry. The latest (April) Federal Reserve’s Senior Loan Officer Opinion survey noted an increase in the number of banks that were tightening their lending standards in the first quarter of 2023. The survey also mentioned a weaker demand for credit and that respondents expect these trends will continue over the remainder of 2023.

Tighter lending standards do not bode well for the construction sector in the short term. With the planning queue on a generally downward slope since the beginning of the year , the potential effect on Construction Starts will add to the risks facing construction employment in the short term.