Starts values predicted to remain flat amid economic downturn thanks to Chips Act, IIJA and other legislation

Introduction

Chief Economist Richard Branch, in his keynote speech at the Dodge annual OUTLOOK 2023 event, shared projections for the upcoming year: the value of construction starts will flatten in 2023.

Reflecting on Q1, the data shows that the overall starts forecast has little changed.

“We are on track with our initial 2023 forecast from last year,” says Branch. “We predicted that starts value would remain flat; however, that’s too simple to end on. Considering inflation and allocated project funds, we’re still on the razor’s edge of a recession, even if we don’t see a strong decline in the numbers. That’s not to say every sector of the industry will struggle; manufacturing continues to show positive growth, supported by the passage of the CHIPS and Science Act last year.”

In this recap, Dodge Construction Network, North America’s leading provider of data and analytics for the construction industry, will reflect how that forecast has held up after three months into the new year. It will also summarize key findings from Q1 that support these foresights, especially as funds from the Infrastructure Investment and Jobs Act (IIJA) are allocated, and projects take off in real-time.

Economic Outlook First Quarter

At the close of the first quarter, we find the U.S. economy at a crossroads. The labor market is showing that jobs are being created, labor participation is flat, and the trades are one of the biggest areas with job openings. However, core inflation has not slowed enough, despite numerous interest rate increases from the Federal Reserve. As a result, the Fed is going to keep raising rates until there is a feeling that inflation is under control. Every additional rate increase raises the odds of a recession.

An Abrupt Event: The Banks

Overall, the U.S. banking system is healthy, but smaller regional banks could face difficulty, and many have begun to tighten lending standards. These smaller banks are the lifeblood of the construction sector – providing credit not just to contractors, but also loans to developers for many types of projects. Should credit continue to tighten, it could put many small players in the construction sector in difficult situations and potentially lead to a sharper pullback in construction starts.

Public Funding

As of Q4 2022, total announced funding associated with the IIJA had reached US$186.3 billion, to be distributed across more than 6,900 projects, continuing to boost construction. As we start 2023 and start thinking about 2024, these will likely be the biggest growth years for infrastructure dollars whether it’s for street, bridge, water or sewer. This raises the question of whether the construction industry is equipped to handle these ongoing and still forthcoming nonbuilding projects.

With public funding from the CHIPS, IRA, and IIJA legislations flooding into the construction sector, leading to larger and larger construction projects, but potentially creating a bifurcated market. Areas of the country where large manufacturing and infrastructure projects are happening should be solid in 2023. However, those areas that rely on small and medium building projects could feel enhanced pain as the year progresses.

Worker Shortage Threatens, But Does Not Halt, Projects

The projected influx of infrastructure work is dependent upon a construction workforce that faces a considerable labor shortage. Many industries like construction may keep hiring and resist cutting jobs, even if demand slips and the economy worsens.

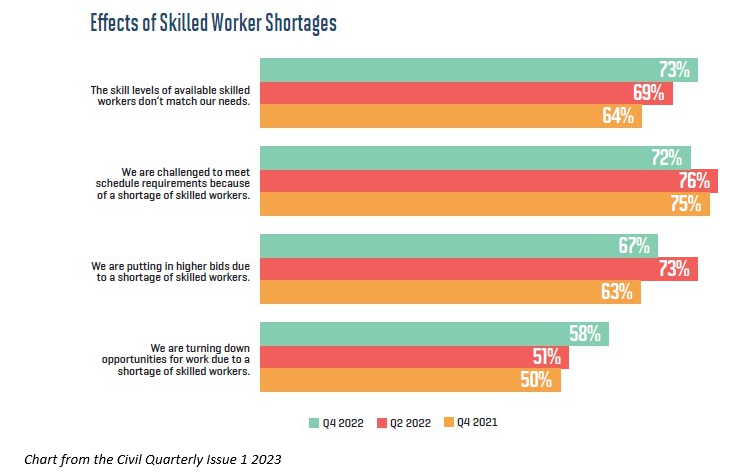

Research from Dodge’s 2023 Issue One, Civil Quarterly found that civil contractors are concerned about where they’ll find sufficient numbers of skilled, properly trained talent at all levels.

The research report shows a considerable number of contractors are expecting an increase in revenue, with more than half of those (62%) attributing this to expecting more work. At the same time, a majority of contractors report a high need for skilled laborers; 72% are experiencing extreme difficulty sourcing the right workers. These contractors are also expecting to experience further attrition due to this lack of staff.

While these projects are critical for our national infrastructure, delays throughout 2023 are expected. However, construction is a resilient industry: “delays” do not translate to “incomplete.”

“Finding labor has been a perpetual issue in construction. These labor gaps can impact timelines and even prevent companies from taking on projects, forcing them to sacrifice revenue,” says Donna Laquidara-Carr, industry insights research director at Dodge Construction Network. “Our data clearly reveals that the civil infrastructure sector is still thriving, with increases in both revenue and profit margin consistently reported over the last year. Even if a recession occurs, the funding from the IIJA is likely to bolster this sector for several more years.”

Nonresidential Starts: The Construction Industry’s Samson

Nonresidential building starts were 14% lower through the first two months of the year with office, manufacturing, and education bright spots in what was otherwise a very weak start to 2023 for most of the nonresidential building verticals.

In December of 2022, Dodge found that the year ended with a 27% increase in total starts value nationally. This was the final surge of a productive year for construction. However, January 2023 gave an immediate decrease, with total starts dropping 27% at the start of the year.

While this initial drop may prove alarming, it is not a holistic preview of the year to come. For example, manufacturing starts led the pullback we saw in January, falling 91% following the start of several large projects in December 2022. Dodge had said at the end of 2022 that manufacturing soared in the aftermath of COVID-19 as more companies attempted to improve supply chains by onshoring production. And even with an initial drop-off, manufacturing overall is still a positive segment for 2023.

“The recession’s impact is impartial, but unequal. The nonresidential side of construction is poised for a better year than the residential sector,” says Branch. “As people experience income changes, we see people staying put or sharing living space for financial reasons, weakening the residential sector’s pipeline. Comparatively, non-residential projects are being supported by legislation and ongoing cultural changes we are experiencing post-lockdown such as education starts and a surge in healthcare starts. Funds will continue to bolster the non-building sector, as funds are now being allocated and projects are beginning to enter the planning phase, 2023 could be the biggest year for infrastructure yet.”

Top Metro Areas – March Madness

During the quarter, Dodge reviewed the value of commercial and multifamily construction starts in the top 10 metropolitan areas of the U.S, finding that nationally, this type of construction starts increased 25% in 2022.

Further analysis of newly updated data at the end of March 2023 revealed there are a few upsets amongst the top 10 and offers a glimpse of additional metros, making up the top 16.

“Commercial and multifamily starts across the top 16 metropolitan areas improved 30% in 2022, up substantially from 18% growth in 2021,” stated Sarah Martin, associate director of forecasting for Dodge Construction Network. “Overall, these top metropolitan areas saw impressive growth over the year, as demand for apartments, condos and commercial real estate returned to downtown urban cores – and brought sizable construction activity along with it.”

The New York, Dallas TX, Washington D.C., and Miami FL metropolitan areas jointly accounted for almost half of the commercial and multifamily starts across the top 16 metropolitan areas last year. New York led the pack with $37.8 billion in construction starts, roughly 12% of total US commercial and multifamily starts.

With newly revised Dodge data, Los Angeles, CA was able to crack the top 10, coming in slightly above Seattle, WA. Los Angeles, CA and Boston, MA were the only two metros in the top 16 to see declines in commercial and multifamily construction starts over the year, as high living costs drove demand away from these areas and into more affordable secondary metros and suburban areas.

Looking ahead

“It’s true that we are toeing the recession line,” Branch concludes. “Under a microscope, that flat line is made of jumps, drops and stagnancies. Each construction sector carries responsibility in this financial prediction, but it is non-building that is supporting the pillars preventing a downturn. Even with this stress, data points to an industry well positioned to weather recession storms.”

While a recession will be hard to avoid, existing factors such as a strong backlog and several pieces of new legislation are moving forward to position construction comfortably throughout the year. Recession, or not, the economic landscape is set to change significantly in 2023.

To read a PDF version of this report, please click here